Company Highlight - Games Workshop Group plc

Summary:

Games Workshop (LSE: GAW, OTC: GMWKF) is a Nottingham, UK-based mid-cap hobby company.

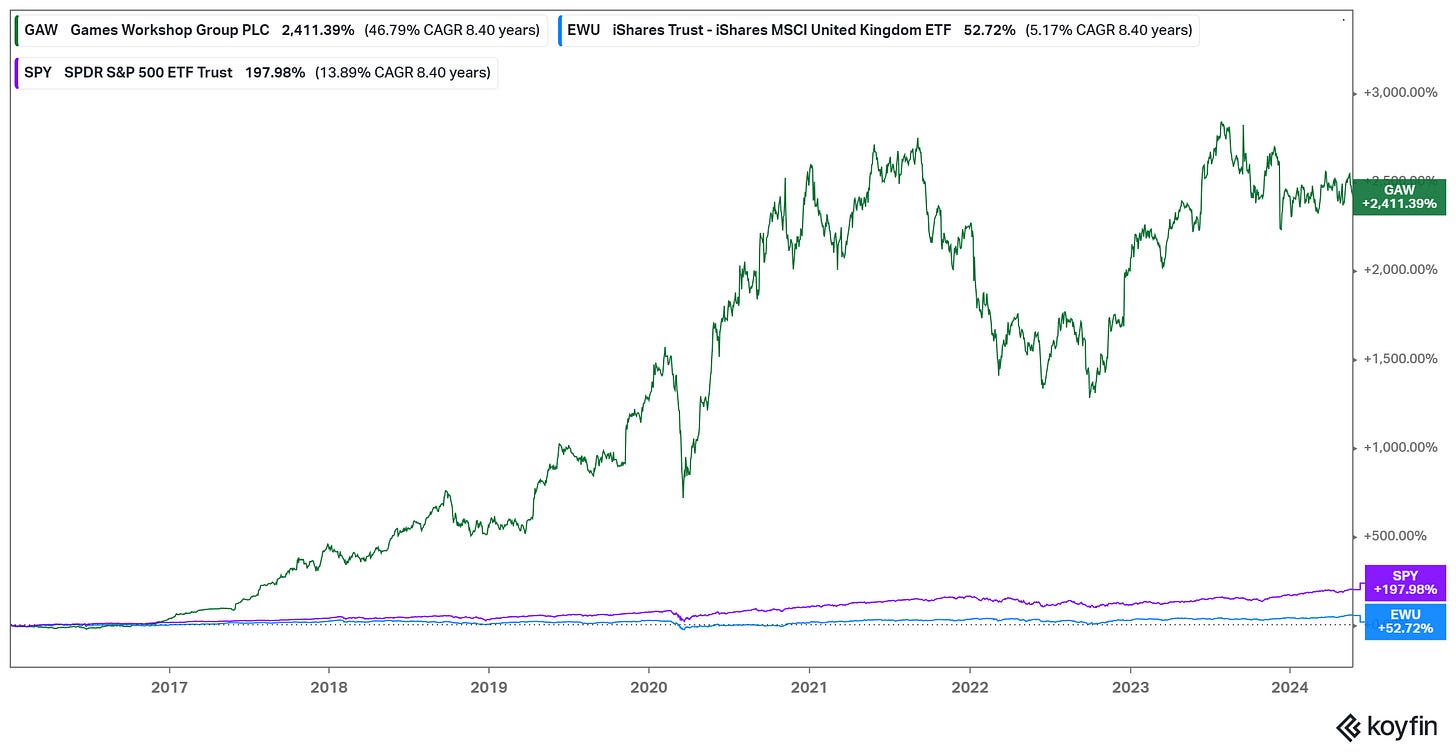

GW is one of the most successful companies (in terms of stock performance) that you probably never heard of.

GW makes plastic and resin miniatures for tabletop board games and owns (and continues to expand) its intellectual property (IP).

The miniature business is a steady growth business with modest profit margins. The IP royalty business has close to 100% profit margins and has taken off over the last couple of years (and the source of stock performance).

The company trades at a premium to its competitors but has a long track record of above-average capital allocation and growth that blows them out of the water.

The drawbacks are that the businesses are economically sensitive, the company doesn’t have an investor relations (IR) group, little visibility on future IP royalty revenues, and an uncertain political environment (in the UK).

Hi everyone,

Today I’m diving into Games Workshop Group Plc. In this write-up, I’ll give a brief overview of the company, its past, and why I think there’s an upcoming catalyst that makes the company an interesting investment.

Games Workshop is a Nottingham UK-based game company founded in 1975. They started off producing wooden games and importing American role-playing games (most notably Dungeons & Dragons).

In 1986, the company changed dramatically with a management-led buyout. The company pivoted towards a new business focus, their own miniature board games called Warhammer (fantasy) and Warhammer 40,000 (Warhammer 40k for short).

The company listed its shares in 1994 and they can now be found on the London Stock Exchange under the symbol $GAW and US-listed ADRs with the symbol $GMWKF.

While I can’t find data going back to 1994 (sorry no Bloomberg here), Games Workshop is without a doubt one of the most successful companies you’ve probably never heard of:

In 2016 the shares started to take off. But from inception to the end of 2015, the company was no slouch.

But in 2016, everything (seemingly) changed.

So what happened in 2016 for the stock to take off? And is it repeatable?

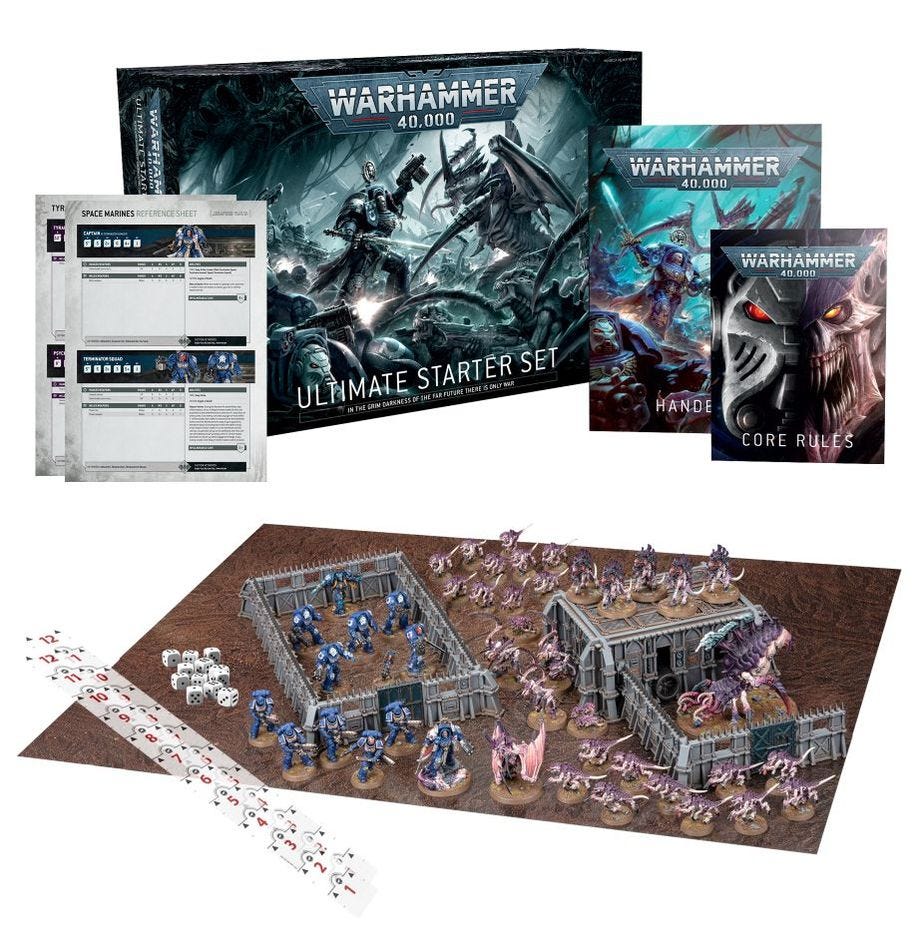

First, you need to understand the company’s business. Games Workshop sells plastic (and resin) models for its customers to assemble, paint, and then do battle in a turn-based game using the company’s IP (intellectual property).

There are two main versions; a dystopian science fiction “Warhammer 40,000” and a high fantasy “Warhammer: Age of Sigmar”.

The miniatures are expensive and can take a long time to assemble and paint. Each unit is given a “points cost” with a standard match being 2000 points. To “assemble” an army would likely cost USD1,000 to USD2000 (very rough ballpark).

And takes most people between 2 and 6 months to assemble and paint (depending on skill level and time committed). Depending on the points, the games themselves can take 2.5 to 4 hours (sometimes longer).

Needless to say, this is a very niche hobby. Even though it’s a niche hobby, top-line revenue growth has grown from ~£120mm in 2015 to ~£470mm last year (or an 18.3% CAGR over 9.5 years)

But that’s not what caused the stock to take off in 2016.

So what caused the huge run in the stock?

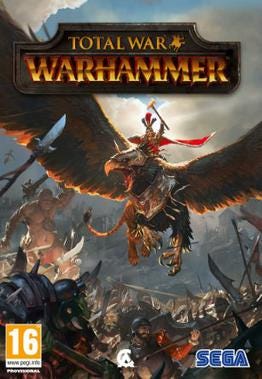

A video game, and this one in particular.

TW: Warhammer wasn’t the first video game that Games Workshop had licensed its IP. They’ve been doing that for 10+ years. But for whatever reason (and it’s been long debated), its IP was only ever licensed to B and C-tier developers that made (mostly) bad games and few that were commercially successful.

What differentiated TW: Warhammer was that it was developed by AAA studio (Creative Assembly) which has developed the Total War series into one of the most successful turn-based strategy series in the world.

Sidenote: I’ve played this game since release and it’s one of my favorites. I’m now kicking myself for not looking to invest in the company since it was released.

The result is that royalty revenue income took off.

What’s so great about royalty income? Well, it has two things that investors love.

The company (in this case Games Workshop) doesn’t have to put up any capital for these projects, which makes it “capital light”. And secondly, GW doesn’t have to spend any money. So any incremental revenue from royalties is 100% profit that goes straight to the bottom line.

With royalty revenues rising, their EBITDA margin has more than doubled from ~18% to ~41% while their net income margin has almost tripled from ~10% to ~28%.

But it’s not all perfect. As you can see, royalty revenues have rolled over recently. Creative Assembly released TW: Warhammer in 2016, TW: Warhammer 2 in 2017, and TW: Warhammer 3 in 2021 and is now winding down.

Since then, there have been lots more Warhammer games released. But none of them were AAA games or major blockbusters. The two biggest successes have probably been Fatshark’s Darktide in 2022 and Owlcat Game’s Rogue Trader released last year.

But it still represents a sea change because Games Workshop has realized the (incremental) value that IP licensing brings to the company. Here is how the company describes itself and its strategy in its 2015 annual report:

Games Workshop's ambitions remain clear: to make the best fantasy miniatures in the world and sell them globally at a profit, and it intends doing so forever. All of our decision making is focused on the long term success of Games Workshop, not short term gains.

Here is the updated strategy from last year:

Games Workshop is committed to the continuous development of our intellectual property (‘IP’) and making the Warhammer hobby and our business ever better.

Our ambitions remain clear: to make the best fantasy miniatures in the world, to engage and inspire our customers, and to sell our products globally at a profit. We intend to do this forever. Our decisions are focused on long-term success, not short-term gains.

The catalyst for a new upturn in the company’s royalty revenues is coming in the fall. Sabre Interactive will be releasing the long-delayed and highly anticipated Space Marine 2.

Space Marine 2 will be Game Workshop’s first AAA game since Total War: Warhammer. And it being a third-person shooter will have a much wider audience.

Whether it’s by luck or by plan; Space Marine 2 has the potential to be the biggest game of the year. 2023 was a banner year for AAA games, capped off by Larian Studios Baldurs Gate 3 (IP licensed by Hasbro’s Wizards of the Coast). But so far this year, the number of AAA games released has been much smaller, reviews have been poor and customer reception has been frosty.

Given the long development time and initial positive impressions by reviewers who have played the beta versions. SM2 likely won’t disappoint (although there’s always a chance the full release misses the mark).

One of the problems (which I’ll get to in a bit), is that the royalty license agreements aren’t publicly available. So it’s very difficult to forecast GW’s future royalty revenues.

For comparison, Hasbro whose subsidiary Wizards of the Coast owns the rights to the Dungeons & Dragons IP collected over USD$90mm in royalties off Baldur’s Gate 3 within the first 6 months of release.

Now there’s no guarantee that Space Marine 2 will be as successful as Baldur’s Gate 3. Or that the IP licensing agreement would generate a similar amount of revenue. But I think there’s at least a very good chance that it’s a commercial success.

And successful games have been shown to drive interest in the company’s miniature business and other properties.

Then there’s the final frontier, which is television and movies. Up until now, there haven’t been any television shows or movies set in the Warhammer universes.

This is about to change. Games Workshop is partnering with Amazon Studios and A-list Hollywood star Henry Cavill (himself a lifelong Warhammer fan) to bring Warhammer to a screen near you.

This is still very early days and the only information we have is that it will be set in the Warhammer 40K universe. It’s unclear if it’ll be a movie or television show (like Game of Thrones). And it won’t be released for another two to three years (at the earliest).

But it’s a start and should the project be a success, it could set up GW’s IP royalty business for decades to come.

I don’t watch very much TV (or movies) so I’m hardly an expert, but I can see some pros and cons. Amazon Studios has never been shy about spending money and has a huge distribution system (via Amazon Prime). But Amazon Studios hasn’t had much success producing original content (especially compared with Netflix or HBO).

They won’t be starved of source material at least. Games Workshop owns its own publisher (Black Library) and regularly commissions writers for short stories and novels set in the Warhammer universe. The Horus Heresy, which is the foundational lore of the Warhammer 40K universe, is an initial three books (trilogy) telling the story and another 61 stories surrounding the events.

In total, Games Workshop has commissioned and published over 200 books. So if the partnership with Amazon Studios goes well, this could be the start of something big. As of right now, there’s a lack of original IP in television and film (and its biggest competitor Disney has squeezed almost every ounce out of its Star Wars and Marvel IPs).

So to recap, Games Workshop’s miniature business is profitable and growing steadily. Meanwhile, the company’s royalty income has the potential to increase dramatically over the next couple of years and power the shares higher.

So what’s it worth? That’s the problem because I’m not sure.

The traditional method would be to build a DCF (discounted cash flow).

I’ve built a basic DCF model to show the company's and shares' upside potential. But my confidence in the assumptions and predictions is very low:

First off, I’m well aware that this isn’t a real DCF model. I haven’t subtracted CAPEX and added back non-cash expenses (depreciation and amortization). Over the last couple of years, they’ve more or less canceled each other out. The company has zero debt and generates a negligible amount of net interest income as management pays out a variable dividend with the excess cash flow.

Now for the assumptions. Over the last decade, the company has managed to grow core revenues (aka the business ex-royalties) by 18% CAGR but it’s economically sensitive (for instance, during the GFC revenues fell by 20%). So if you assume 15%-18% growth in the good years and one bad year where revenues fall 20%, then it works out 10% CAGR.

Forecasting licensing revenue is a complete crapshoot. I’ve probably under-estimated 2024 (if Space Marine 2 is a massive hit), and have no idea what it will be beyond this year. Directionally I think licensing revenue will trend up (and possibly by a lot) if the partnership with Amazon works out well and there are more AAA games released. But the whole segment is a complete question mark.

Even the corporate tax rate is a bit of a question mark. The current tax rate in the UK is 25% and there’s an election coming with the left-leaning Labour Party all but guaranteed to win so the expectation is that corporate tax rates will rise.

But Games Workshop has historically averaged a 20% tax rate (and it’s been falling). This is probably thanks to their revenues increasingly coming from outside of the UK and from IP royalties which gives rise to some opportunity for “tax planning”.

Finally, there’s the discount rate which I ended up using 10%. Games Workshop is a small-cap company and revenues are economically sensitive which should add to the discount rate. But it’s also highly profitable and has zero debt which makes it safer.

The alternative to DCF is to use comparables. For competitors, there aren’t a lot of publicly listed toy manufacturers out there. The usual comps are Hasbro (HAS), Mattel (MAT), Spin Master (TOY), Build-A-Bear (BBW), and sometimes Disney (DIS).

Valuation-wise, Games Workshop trades at a hefty premium. But if you consider the fundamentals, the premium valuation looks more than justified.

In terms of growth, profitability, and quality. Games Workshop blows its competitors out of the water. Its results are more akin to the mythical software/SaaS company.

And this isn’t just a phenomenon of the last 12 months either. Using GW’s favorite metric, return on invested capital (ROIC), you can see the consistency in their profitability and capital allocation over time.

I’ve sung the company’s praises enough, so what are some flaws and concerns investors might have with Games Workshop?

The first big concern is the economy which I’ve touched on a bit already. The company’s revenues are economically sensitive (people aren’t spending hundreds or thousands of dollars on a hobby when times are tough). While the evidence is pointing to a slowdown in the global economy, I’m still in the soft landing camp.

Governments are just spending far too much money via fiscal spending for growth (and inflation) to turn negative. If governments started to pull back on the fiscal spending, I would get worried. But we’ve seen no indications of that anywhere (yet). And if central banks overreact and start cutting rates aggressively, we could very well remain in a stagflation environment.

As for competitors in the miniature business, they come and go over time. Some YouTubers, who got their start by recording Warhammer games (often called Battle Reports), have tried to create their own miniatures business. But even they admit how challenging it’s been to build large quantities of (high-quality) miniatures and generate a profit.

The bigger (and perennial) concern has been 3D printing and the allure of making your own plastic models (to save money). This risk hasn’t materialized yet as high-quality 3D printers are still expensive. The designs are very hard to find, the entire process is quite time-consuming and most people don’t have the skills to do it themselves. So at least in the short to medium term, I think the risk is largely overblown.

A bigger issue many shareholders will have is the lack of investor relations at the company. The company reports twice annually (like many European companies) but doesn’t do earnings conference calls. There are no presentation decks and as far as I can tell, they never present at any of the TMT (tech, media & telecom) events hosted by the major banks.

This shouldn’t be a huge problem. But combined with the lack of guidance on IP licensing revenues, I think it could be a deal breaker for a lot of investors.

Management has a very long track record of delivering on their promises and executing. But you’ll need to put all of your faith in them.

And then there’s shareholder returns. Management pursues a variable dividend policy, whereby they pay out excess profits as dividends. I know many US investors are not fans of dividends and would much prefer share buybacks. However, there hasn’t been any indication that the company will change its shareholder returns policy.

As for the IP. At some point, it will become oversaturated. But when that happens, nobody knows. It took Disney over a decade to oversaturate the Star Wars and Marvel IP (while releasing movies and shows every year). It will probably happen sooner in video games, where licensing has been going on for a long time. But TV/movies IP hasn’t even started so overall we won’t see a peak in IP revenue for at least another 5 years, maybe even 10 years.

Lastly, there’s the political environment in the UK with Sunak calling for an election on July 4th (somewhat ironic). The left-leaning Labour Party has a 20+ point lead in the polls and looks to sweep the election.

I doubt a change in government would hurt the company. The Conservatives have been in power for over a decade and have been terrible stewards of the economy (Brexit, Liz Truss, energy windfall taxes, etc.) so I’m not sure if it could get worse with Labour coming to power.

But on the other hand, look at Mexico which just had an election. AMLO’s protege and chosen successor Claudia Sheinbaum won the election, but that was widely expected. But she got a super majority and so even though AMLO governed as a pragmatic centrist, Mexican stocks sold off by more than 15% (including the drop in the Mexican peso).

And we’ve now just had the European elections. As a result, French President Macron has called a snap election which has caused French stocks to go down.

So while I’m bullish on the company long-term. I’m not in a rush to invest. I’ll wait for the election and see if I can scoop up some shares around £90-£95 (GAW: currently trading around £99.5).

Hope you enjoyed my write up and if you have any comments or questions just leave them down below.

Jonathan

Disclosure: I am long and have a beneficial interest in all of the above-mentioned securities. I may change my holdings at any time post-publication.

Disclaimer: This newsletter and/or any other articles that I publish should not be construed as investment advice. None of the strategies or securities mentioned should be considered as an investment recommendation to buy or sell. I am not an investment advisor and I highly recommend that anyone considering this investment strategy or any of the securities first consult with a registered investment advisor to assess both the suitability and risk of any strategies or securities that are mentioned.