Sleepy Portfolio - Calm Before the Storm or Mea Culpa (May Edition)?

Hi everyone,

Sorry for being a couple of days late. I was waiting for gold to bottom out so I could make some changes to the portfolio. But Moody’s had other plans when they downgraded the US credit rating Friday night.

I’m not sure why it’s significant, as the fiscal trajectory of the US is a well-known disaster. But more on that shortly.

April and the beginning of May was one of the wildest periods in markets in a very long time (possibly ever). Equities led by the the US tanked after “Liberation Day” and then staged a stunning rebound.

I know the rationale for the bounce is that Trump has caved/folded/retreated from his maximalist tariff. But the tariffs are still higher now than they were before April 2nd (China is still at 30%). And while that may be enough to avoid a recession now. The hit to both business and consumer confidence is large.

Maybe I’m just totally wrong and this is all part of Trump’s “plan”, the US economy continues to hum along, and US equities return to their glide path of mid to high teens returns every year (like the last ~15 years).

Or maybe this is just the calm before the storm, as US companies continue to announce great Q1 results (which ended right before “Liberation Day”). But the damage slowly reverberates through the economy.

Small businesses have been especially hard hit as they don’t have the supply chains or balance sheets (to stock up on goods), so they’re in a very difficult spot. And now with the “reset” with China, they’re in the unenviable position of trying to decide whether they order now (with the reduced tariffs) and hope their products get here before the end of the 90-day reprieve.

But what if Trump changes his mind? Or what happens if the economy rolls over and they’re stuck with inventory they can’t sell? There’s no easy answer.

To complicate matters, the other big countries sitting on the sidelines (Canada, EU, etc.) are watching what’s going on and learning (to wait for Trump to cave). Trump, meanwhile is now threatening to impose unilateral tariffs (again) because his trade team doesn’t have enough time to sign trade deals before the “90-day pause” ends.

It’s all a big mess. Most estimates have all the current tariffs costing the average US family an extra $2,500 or so. Tax hikes aren’t popular, and have already led to the big dustup between first Amazon and now Walmart.

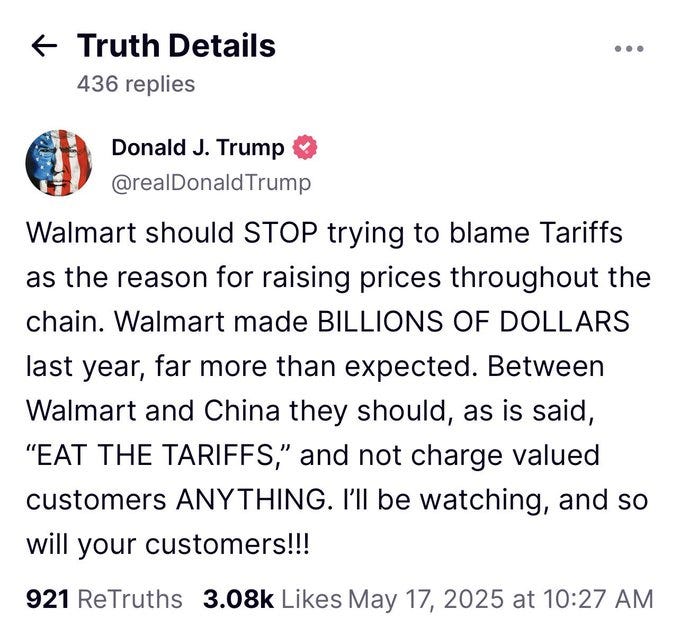

From “the most business-friendly administration I’ve seen in my lifetime”, Trump wants Walmart to eat the entire cost of the tariffs (which would exceed all of their profits).

Because despite what Trump says, it isn’t the other countries that pay the tariffs. It’s the consumer. The rest of the big retailers report this week too, so it’ll be fascinating to see what happens here.

And if you think the tariffs are going to be unpopular, wait until you see what’s in the “Big Beautiful Bill” as Trump likes to call it. Not only will it extend and make his 2017 tax cuts permanent, but it’s chock-full of other goodies (for some, but not all).

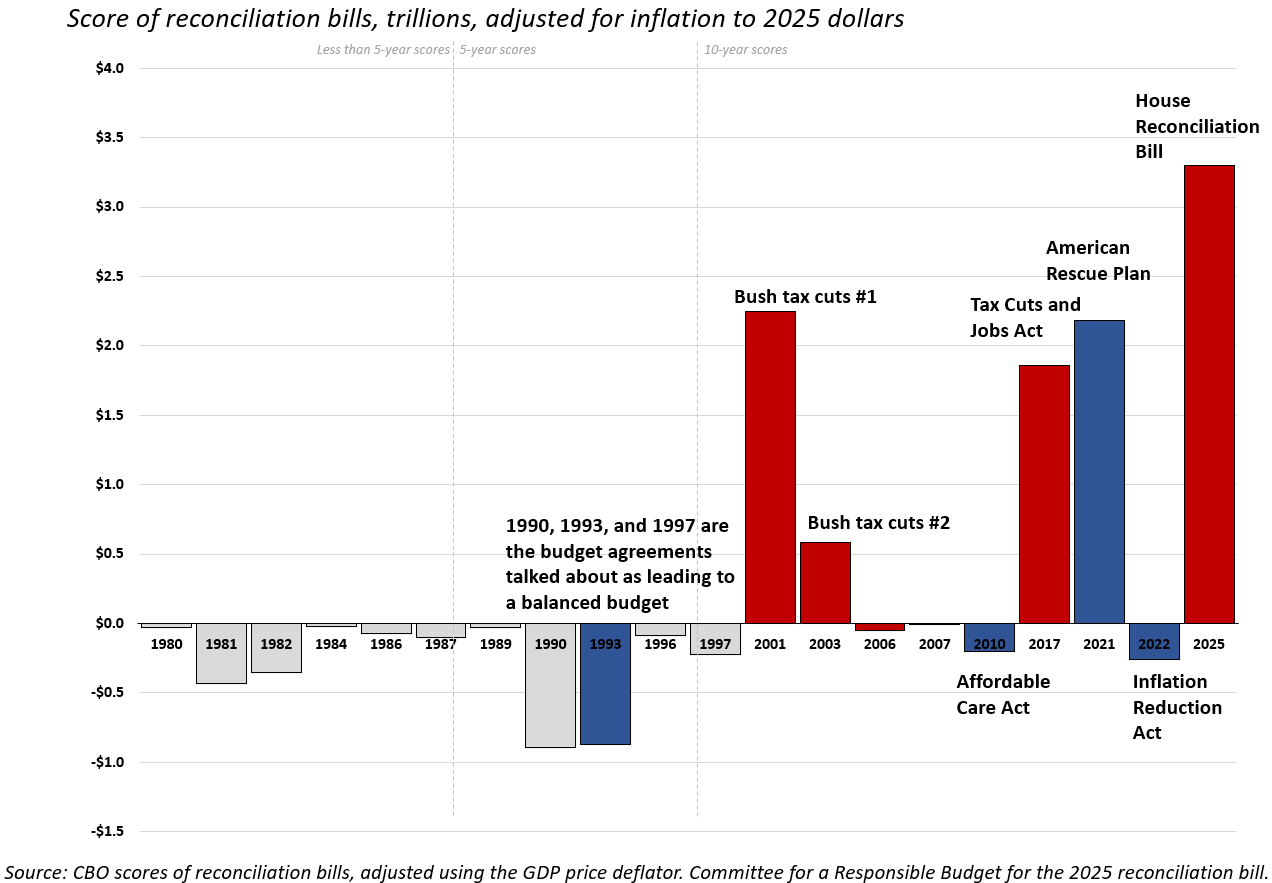

The bill (as currently written) will completely blow the doors off the deficit (and that’s with all of the fancy Washington accounting shenanigans thrown in). But it’s not like deficits matter, right?

These projections are also assuming that we see strong economic growth and no recession either.

And it gets worse. As Jessica Riedl from the Manhattan Institute noted, the bill assumes that interest rates/costs will never exceed 3.6% over the next 30 years. If that 3.6% is replaced with current interest rates, it will add another $40 trillion in debt over the next 30 years (but what’s that between friends?).

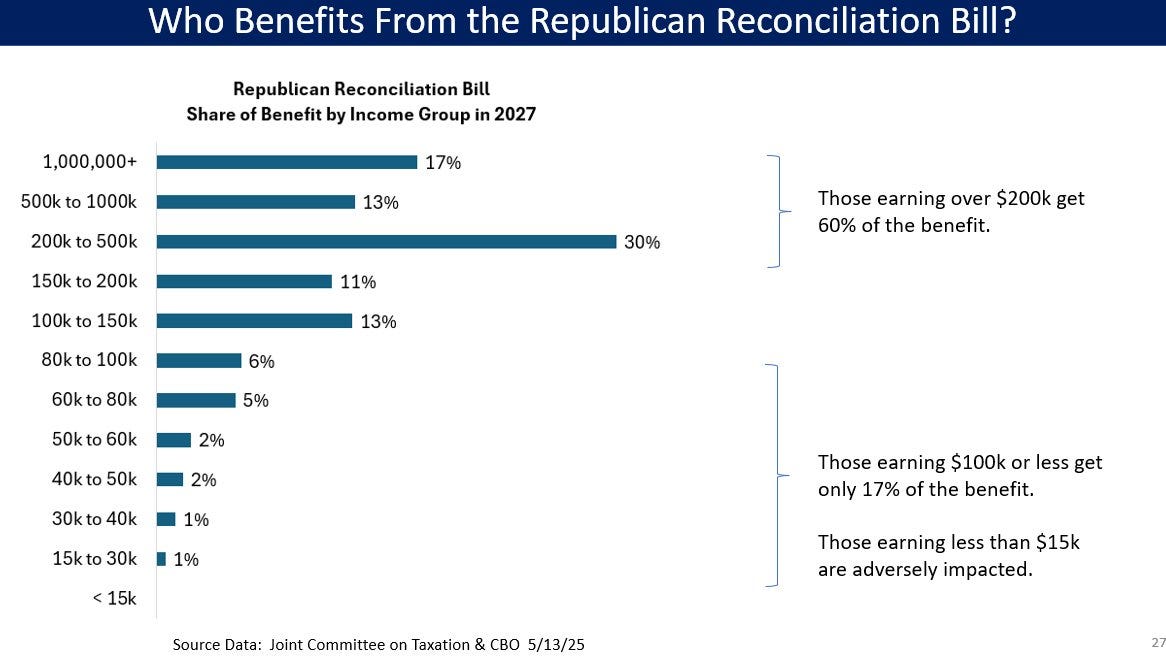

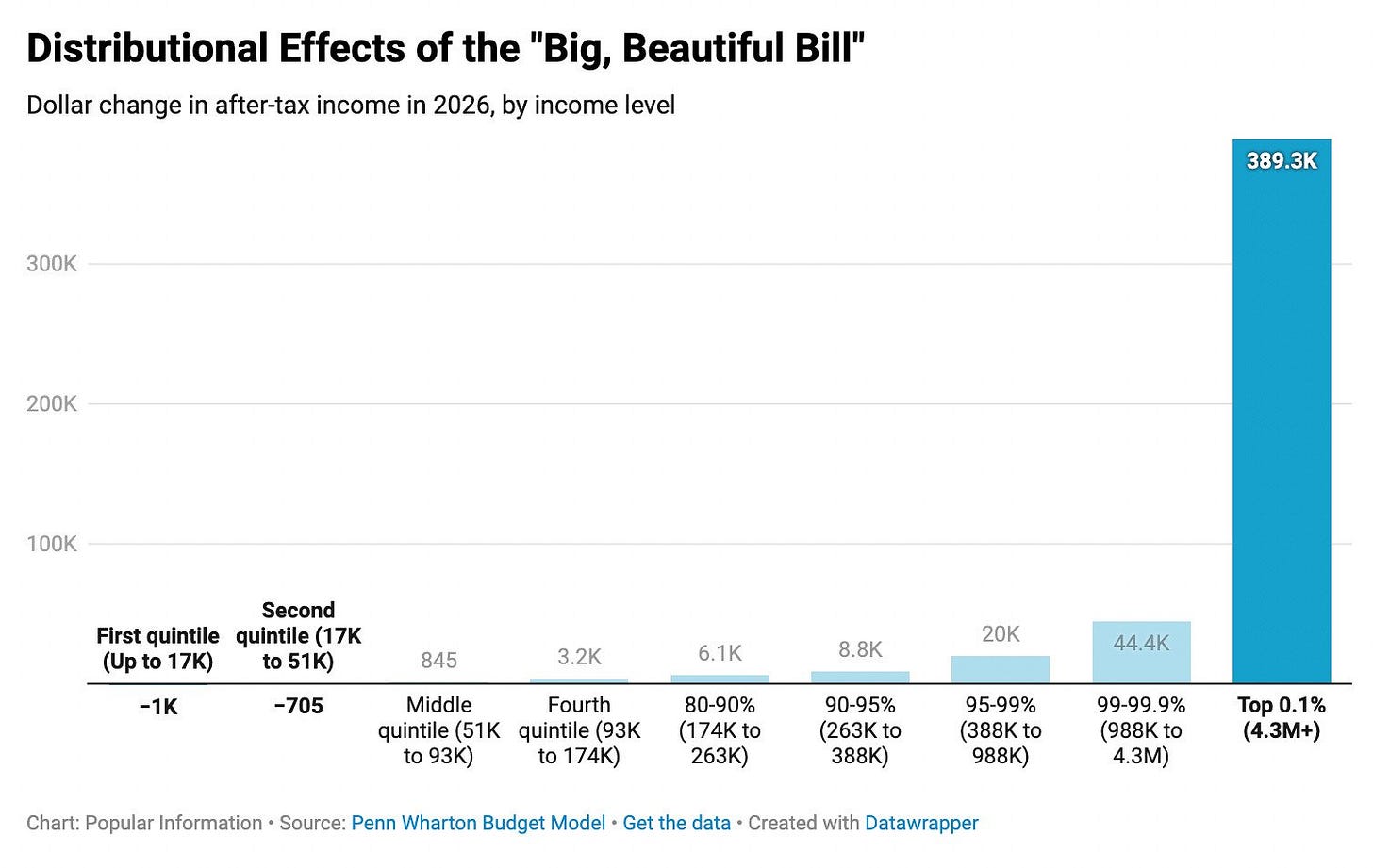

Not everyone will benefit from the House Reconciliation bill either. There are big cuts to social programs like Medicaid and Food Stamps (along with other smaller cuts) to offset some of the costs of the tax cuts. In short, the top 1% will capture the majority of the benefits (and the top 10% capture almost all of it).

The bottom 20% will on net lose money, and the next 30% will see negligible gains. The politics can be discussed elsewhere. But the economic impact can’t be ignored.

Most people spend every dollar they make (especially the bottom 50%). While the wealthy (call them the top 10%) have a higher propensity to save (as they already own a car, house, eat at restaurants, etc.). Throw in the tax hikes from tariffs, and the bottom 50% are about to be in for a very rough time.

So I think the economy will take a pretty big hit. But a government’s deficit is someone else’s income. So maybe the wealthy will funnel their newfound tax savings back into assets despite a weak economy?

One group of investors does care. And that’s bond investors.

US long-term bond yields keep grinding higher. US 30-year Treasury yields briefly made a new high this year, and it’s not just the US either. While European yields have gone up a bit, the prize goes to Japan which is seeing yields soar.

It’s not great for economic stability (or growth), and it makes the big rebound in equities (particularly US equities) all the more confounding.

While equities soared, gold pulled back about 10% from its all-time highs on the trade war “calming down”. And the gold equities took an equally big hit.

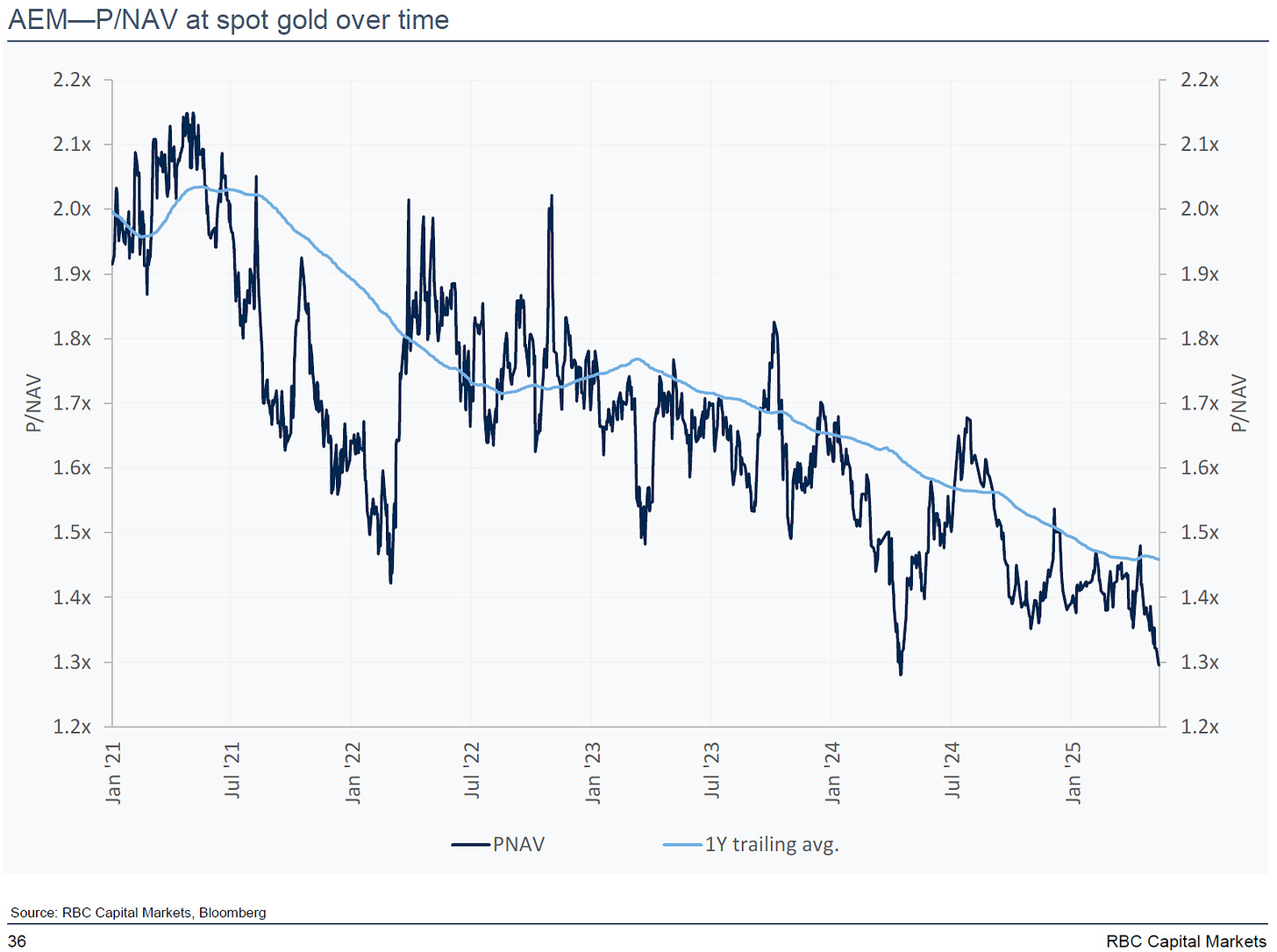

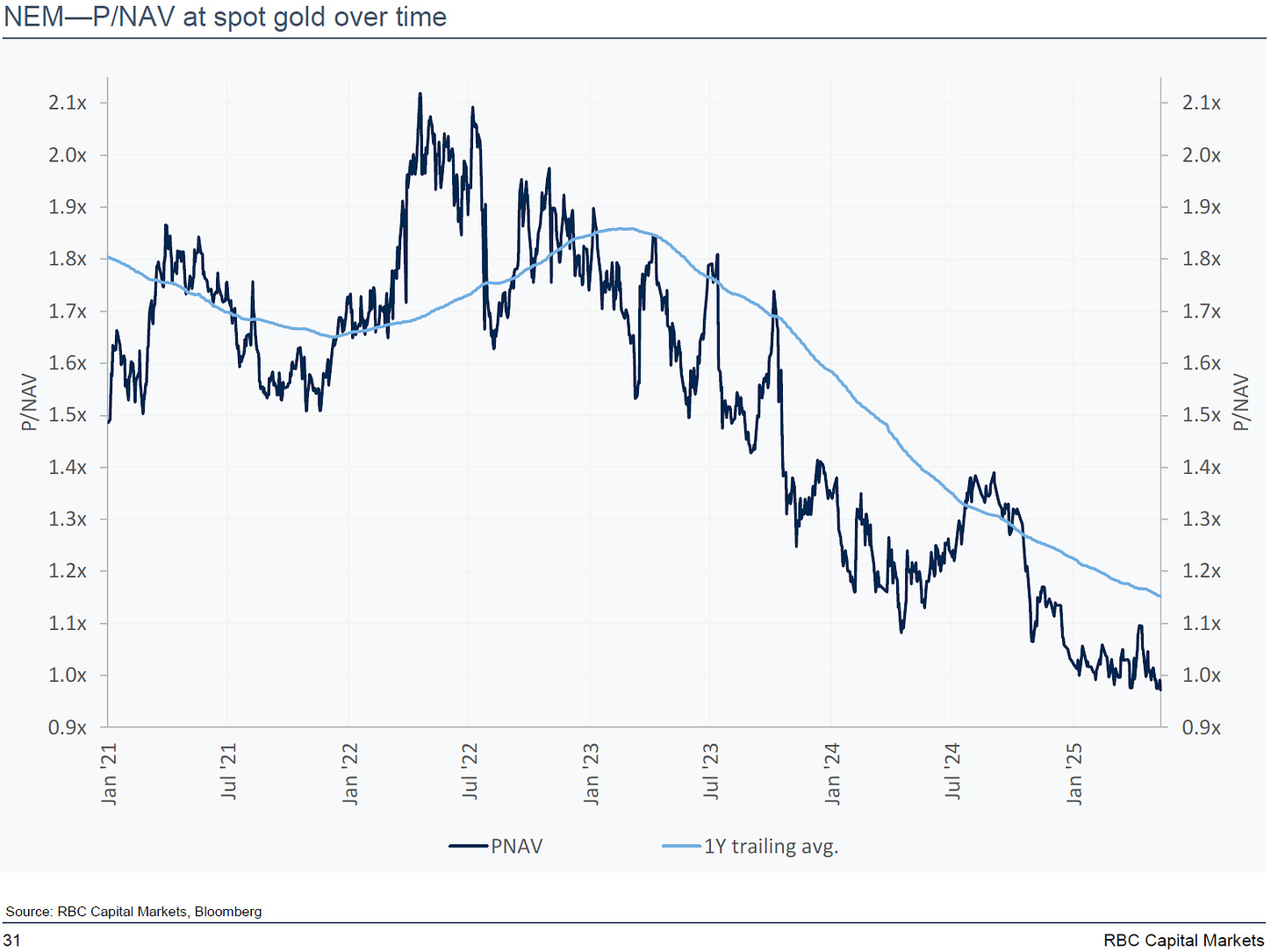

I think investors continue to underestimate just how cheap and profitable gold miners are, given current spot gold prices and oil/diesel costs. Here are a couple of price-to-NAV charts by RBC (but they all look the same).

So I’ll be taking this opportunity to add another gold mining name to both portfolios and topping up the current gold miners back to target.

I wrote back in early February to sell all US assets. I’m making one exception now for Newmont. It’s just been very difficult to find large high quality gold miners outside of North America. And Newmont scores well across the board for shareholder returns, valuation, quality, momentum, etc.

To raise the cash needed, I’ll be selling FMX (Mexican Economic Development) in the Global Portfolio. On the Canadian side, I’ll be trimming Canadian Natural Resources back to 5% (it’s up about 17% since I doubled the size of the position last month).

I’m still bullish on oil. While the price hasn’t improved much, it seems to have put in a bottom. Not surprising given how low oil is now (especially once you start adjusting for inflation).

The narrative around US shale has also drastically changed (and quickly). Shale driller Diamondback Energy (FANG) kick-started it all with its letter to shareholders (worth a read and can be found here). Since then, there’s been a lot of musing that US shale may be at its peak (so much for “Drill Baby Drill”).

The Wall Street Journal has written numerous articles highlighting the rising costs (partly due to tariffs), falling oil prices, and declining inventory of drilling locations causing pain for the US shale industry.

Meanwhile, the IEA with a stroke of a pen, “deleted” 290 million barrels of oil (or roughly half of the US SPR). As they “realized” they had underestimated oil demand for the last 3 years.

Anyone who’s looked at the observable oil data (using firms like Kpler) knews their numbers were wrong. Yet it took them almost 4 years for them to correct this glaring error.

The most incredible thing is that they’re still forecasting large surpluses for this year and next year! And everyone (especially in the media) is taking those projections with a straight face.

In the real world, globally observed inventories declined in Q1 by roughly 15mm barrels, which is highly unusual (as we normally build 75-80mm barrels ahead of summer). Maybe OPEC+ adding barrels to the market has less to do with “punishing” US shale and Kazakhstan and more to do with a tight physical market (or all of the above)?

I don’t know what the catalyst will be to push oil prices higher, but again I think oil prices have bottomed. Using WTI, oil prices might drop into the 50s briefly if we get another big risk-off event (and with Trump, anything is possible).

But given the tightness of global inventories and demand continuing to grow, I don’t think they’ll stay down in the 50s (or even low 60s) for very long. And I still think we exit the year at $75/bbl or higher.

So best of luck out there everyone, and have a great summer (hopefully it warms up because it’s been cold here in Toronto)!

Trades

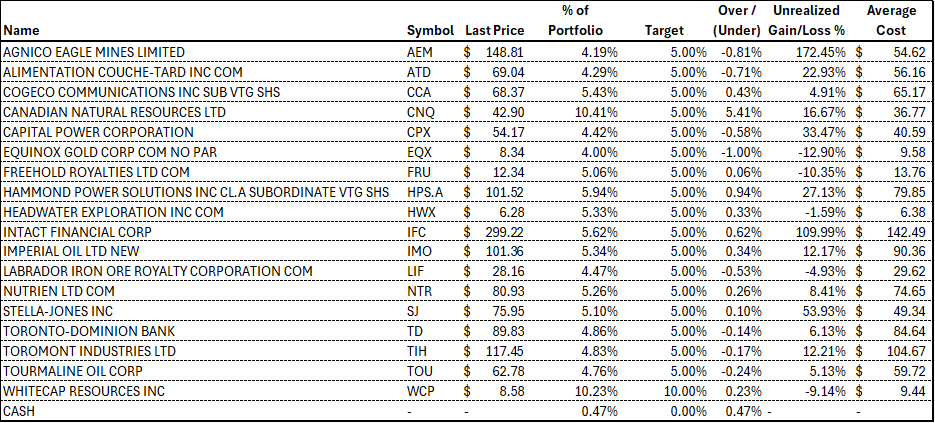

Canadian Portfolio

Buys:

Dundee Precious Metals (DPM)

Top up to target:

Agnico Eagle (AEM)

Equinox Gold (EQX)

Trim to target:

Canadian Natural Resources (CNQ)

Hammond Power Solutions (HPS.A)

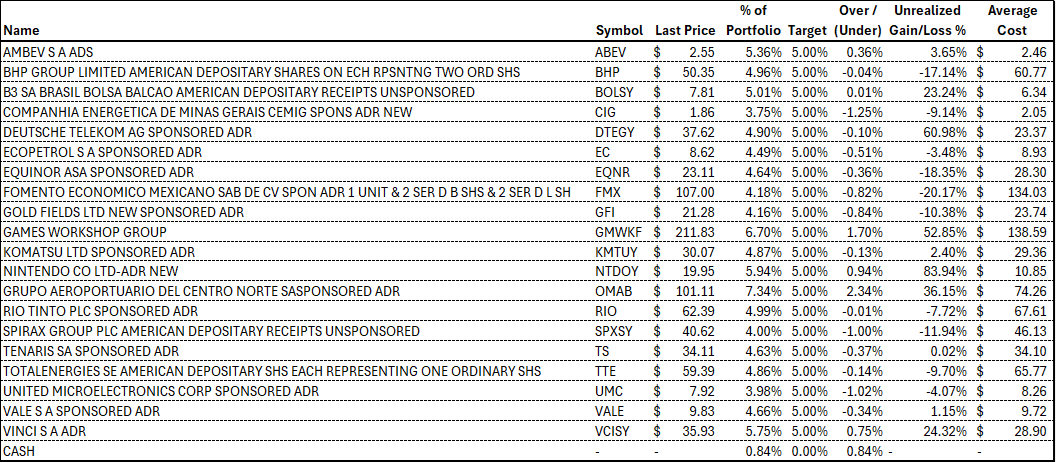

Global Portfolio

Buys

Newmont Corporation (NEM)

Sales:

Mexican Economic Development (FMX)

Top up to target

Gold Fields Limited (GFI)

Trim to target

Central North Airport Group (OMAB)

Portfolio Holdings

Canadian Portfolio

Global Portfolio

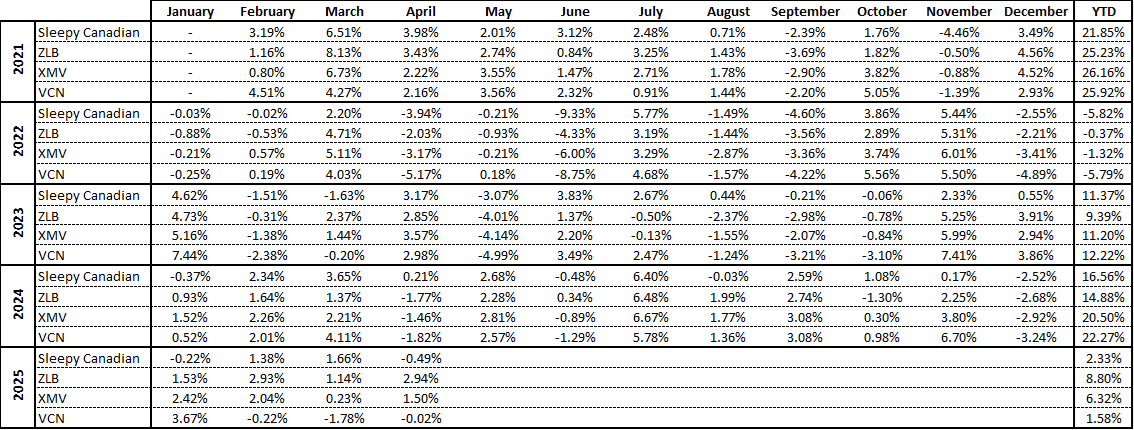

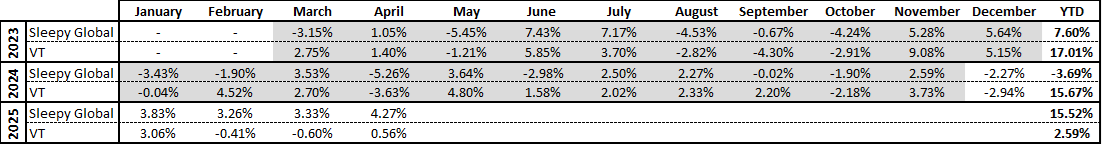

Performance

Canadian Portfolio

Global Portfolio

Disclosure: I am long and have a beneficial interest in all of the above-mentioned securities. I may change my holdings at any time post-publication.

Disclaimer: This newsletter and/or any other articles that I publish should not be construed as investment advice. None of the strategies or securities mentioned should be considered as an investment recommendation to buy or sell. I am not an investment advisor, and I highly recommend that anyone considering this investment strategy or any of the securities first consult with a registered investment advisor to assess both the suitability and risk of any strategies or securities that are mentioned.