Sleepy Portfolio - The Most Important Chart(s) And The Most Confounding Chart (August 2025)

Hi everyone,

Summer is almost over, but there’s never a dull day in the markets (or the world).

This month’s update can be summed up as “beating an (almost) dead horse” because I will be repeating several points I’ve made over the last ~6-12 months.

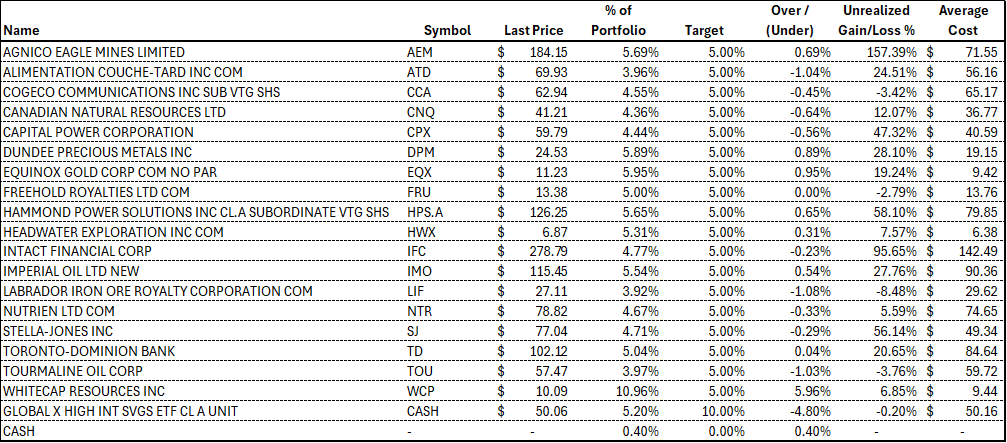

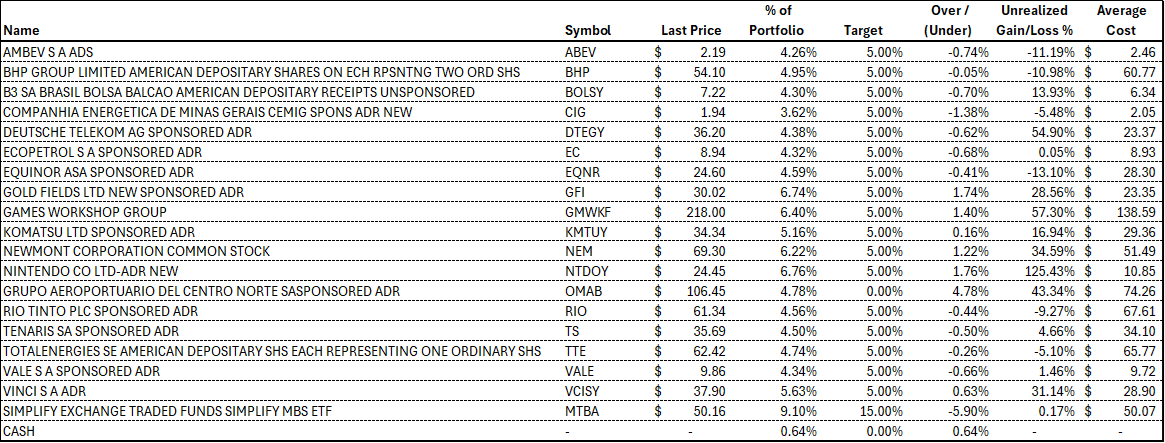

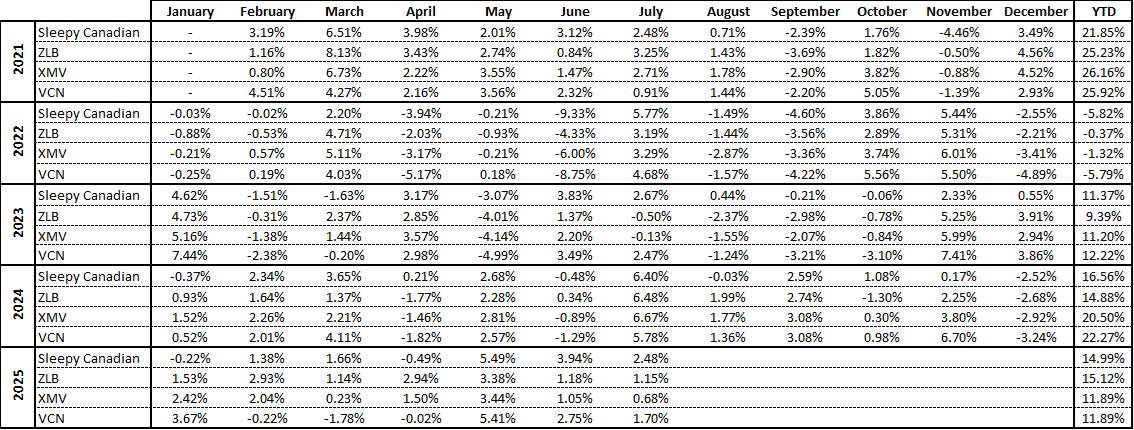

Before that, the Canadian portfolio performed well, thanks to the gold miners and the energy sector. The Global Portfolio had a slightly down month as investors rotated back into US equities. But the Global Portfolio is up roughly 5% month-to-date in August. So after 2 horrific years of underperformance, the Global Portfolio has caught up to its benchmark (VT). All is not lost.

Raising cash in both portfolios hurt performance, but as I’ll dive into below, I’ll continue to raise cash and play defense.

Where to begin, other than the continued clown show in the White House? I know everyone is probably tired of it, and me harping on it. But I refuse to normalize what’s going on.

Trump fired the head of the Bureau of Labor Statistics (BLS) after a poor jobs report. And has nominated a political hack and complete idiot as its replacement. EJ Antoni has no business being anywhere close to a position of power (and if you don’t believe, just check out this compilation).

And to make matters worse, one of EJ’s first comments after the nomination was to float the idea of getting rid of the job report. Unreal. The United States is the gold standard for accurate and timely data collection. The loss might not be felt immediately, but it will have long-term costs for the economy and markets.

Meanwhile, Trump imposed export tariffs on Nvidia and AMD. The only problem is that export tariffs are explicitly prohibited in the U.S. Constitution.

See Article 1, Section 9, Clause 5:

No Tax or Duty shall be laid on Articles exported from any State.

Who needs laws anyway?

Inflation is ticking up again as the tariffs start to bite. Most of the cost of the tariffs are being borne by companies right now. But I’d expect that within the next 3-6 months, companies (such as the car manufacturers) can’t or won’t bear the brunt of it any longer and start pushing up prices even more.

All of this just from the last week. I can go on, but I’m sure we all get the point. The US is speed running downwards to a mix of Argentina’s Kirchnerism, Edrogan’s Turkey, and Putin’s mafia-state (i.e. Russia).

It’s a real shame. That the United States, the “Leader of the Free World” and “Shining Beacon on the Hill” would choose this path is disappointing. And I don’t see any change in direction until at least the mid-term elections next November (if that).

But the markets keep going up and making new all-time highs. So what’s the big deal?

Maybe I’m overreacting, but I’ve seen this story before in companies. Bad things keep piling up. Investors ignore the red flags because the stock price keeps going up. “Markets are efficient” so no need to worry. But then the red flags become too numerous to ignore. Reality hits, and a course correction is required. And the stock crashes back to earth.

Right now, markets are going up. So as Chuck Prince famously said:

“As long as the music is playing, you've got to get up and dance,"

I understand the difficulty of the situation, especially for institutional investors who are given very little room to deviate from their benchmarks. Even if they worry about what might be coming down the pike.

The next shoe to drop will likely be the AI bubble unwinding. But I’m probably the last one to give thoughts on when it’s going to unravel, given how wrong I’ve been so far.

We are just finishing up Q2 results, and once again, the “Hyperscalers” (Google, Facebook, Microsoft, Amazon, etc.) continue to ramp up their capex spending on “AI”.

The spending is so staggering that it is having a material impact on US economic growth (and offsetting sluggish consumer spending). But how long can it last?

I’ve written in the past that they’re all messing around with depreciation and amortization to delay the financial hit as long as possible. But make no mistake, that day is coming.

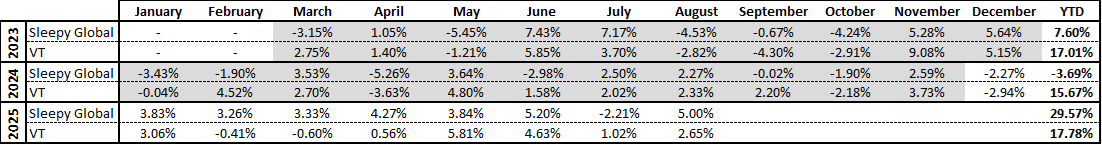

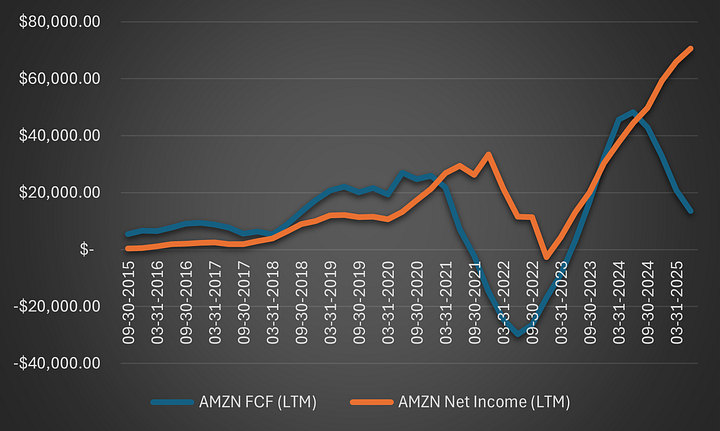

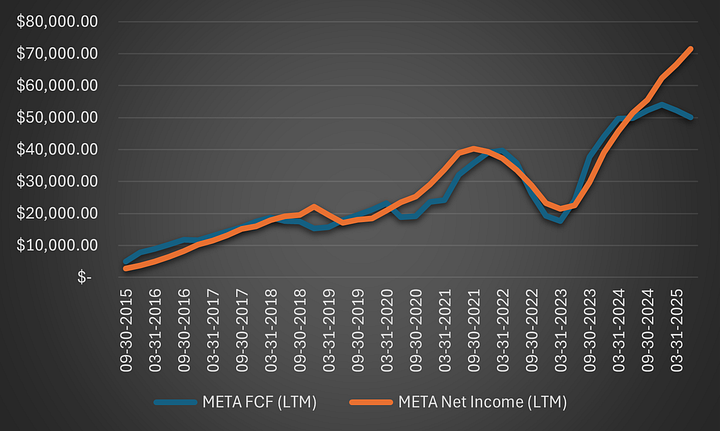

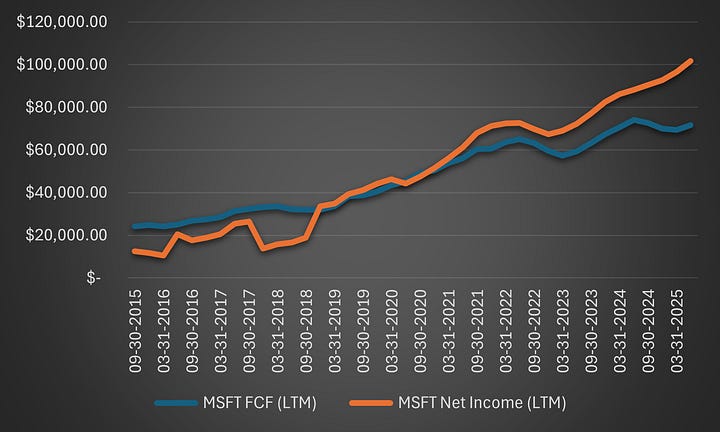

Which leads to the most important chart(s) right now. The huge divergence in net income and free cash flow.

Here they are for the Big 4 Hyperscalers (Facebook, Microsoft, Amazon, and Google).

Ever since the AI bubble kicked off in late 2022. There’s been a huge divergence between these companies’ earnings and free cash flow (and it will continue to grow as CAPEX ramps further).

The (literal) trillion-dollar question is what happens from here? Do revenues from all of this “AI” investment materialize to justify the spending and cause free cash flow to catch up to earnings? Or does the AI revenue fail to materialize (or take much longer than expected) and net earnings roll over due to rising depreciation and amortization expense?

I’m sure you know which side I’m on. Very loud AI bear Ed Zitron just wrote a very good (albeit very long) article on how much of a money sink “AI” has become (can be found here). And so far, even using “Silicon Valley math” these AI firms are generating only a tiny amount of revenue (relatively to money spent).

Not helping matters is that OpenAI just released its much hyped ChatGPT5, which has been nothing short of a disaster. Both performance and accuracy have taken major steps back. And I’m not sure how you could fix it without an entire model rewrite (but I’m no expert).

But even as bearish as I am, this isn’t the dotcom bubble (at least for the Hyperscalers). They still have immensely profitable legacy businesses. So there’s no risk that they will go bankrupt (unlike the fiber optic companies).

But given their market caps and weights in the indices like the S&P 500 and NASDAQ, it will still be painful.

And I’m not a complete bear on “AI” either. I just think these LLMs will never succeed (economically).

Where can “AI” work? Take a company like Walmart that has hundreds of billions of data points (transactions, shipping & logistics, etc.), meticulously cleaned, and a well-funded data sciences team.

Walmart would be an ideal candidate to implement “AI” to improve their business (at the margins, as they’re already very good/efficient at what they do). In theory, these improvements should lead to higher profit margins for Walmart.

But the productivity paradox means that Walmart’s competitors (Costco, Target, etc.) will likely do the same thing. So they all become more efficient, but their margins remain constant. The beneficiary is the economy as productivity increases.

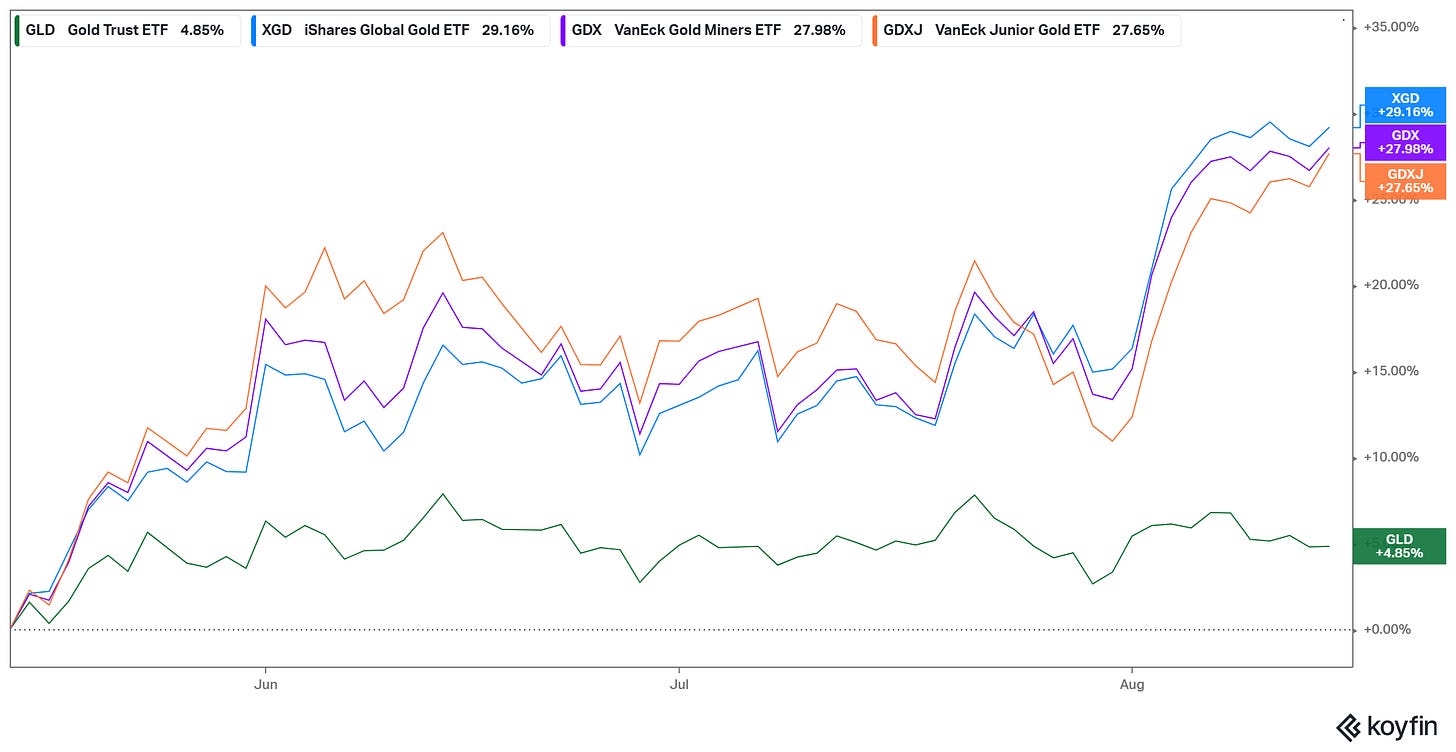

One area that I’m not complaining about is the gold miners who’ve finished up a very good Q2. Gold prices have largely remained flat for the last 3 months, while gold miners have caught quite the bid.

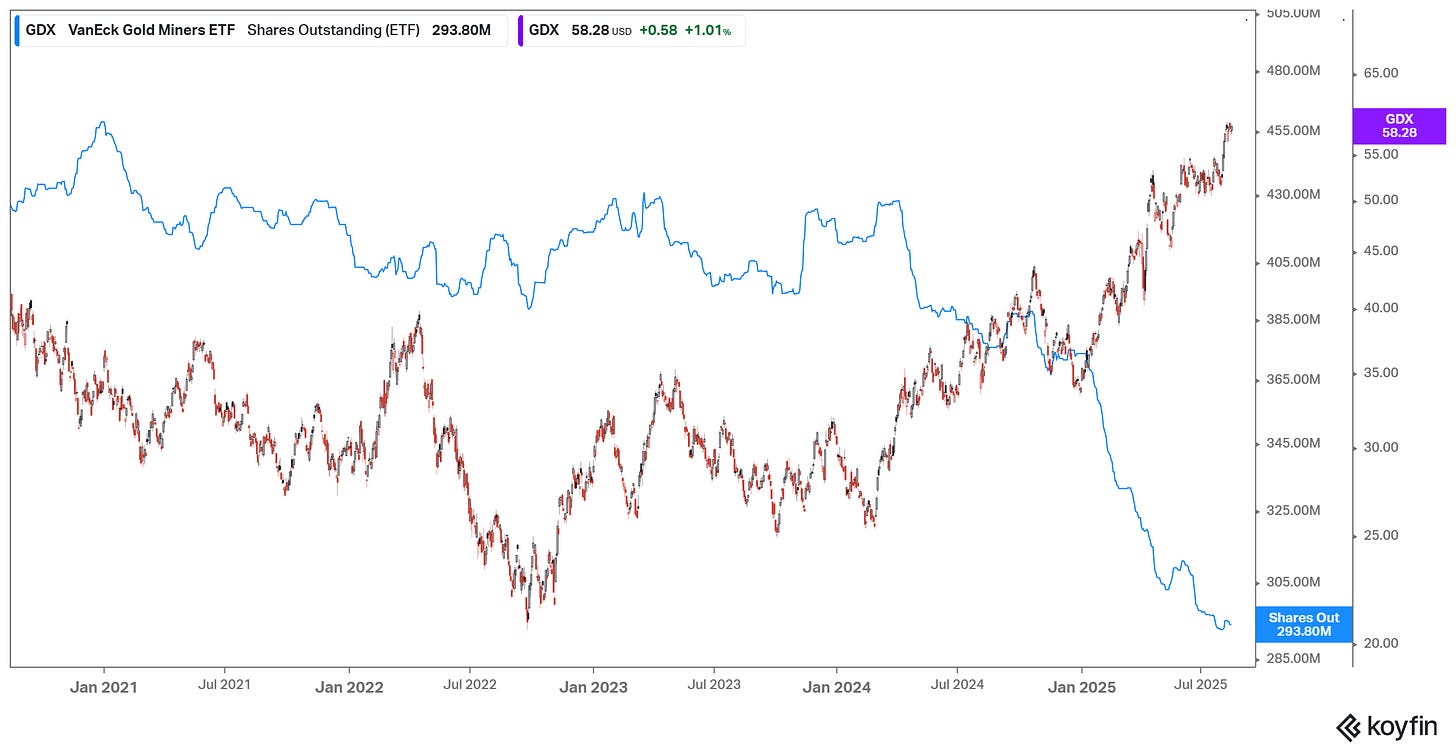

Which leads to the most confounding chart out there. Even as gold miners’ shares touch all-time highs, shares outstanding in ETFs like GDX continue to decline.

In a world so heavily dominated by trend and momentum investing (and performance chasing), you’d think it would be the opposite. But nope.

So while both portfolios are now overweight gold miners due to the recent run. I’m going to avoid trimming them until I see this trend turn around. Gold miners are still cheap versus the broader market and their own historical standards. But they aren’t screaming cheap like they were 2 or 3 months ago.

Lastly, I started raising cash in both portfolios last month, and I’m going to continue doing that this month. The plan right now is to continue waiting until the fall and to see what happens with the economic data and markets.

It will continue to be a drag on performance (if markets continue to rise). But gives a lot of flexibility and optionality, should something break or there’s a dislocation in the market.

To accomplish this, I’ll be trimming Whitecap Resources (WCP) back down to a 5% position now that it’s fully recovered from the liberation day sell-off. I’m still bullish on oil long-term, and 2026 is shaping up to be a better year for oil.

But with OPEC fully unwinding its cuts, this fall might be a bit rocky. US shale is already rolling over. But will the combination of global demand growth plus US shale decline be enough to absorb the increase in OPEC supply? Probably not in the next 3 to 4 months.

On the global side, I’ll be selling the Mexican airport operator OMAB. It’s a fantastic business (maybe too fantastic), but I’m worried about just how sensitive the business is to both Mexican GDP and US manufacturing. Neither of which are doing great right now with all of the tariffs and trade uncertainty.

So best of luck everyone, and enjoy the remainder of summer!

Trades

Canada Portfolio

Trim (to 5% weight):

Whitecap Resources (WCP)

Global Portfolio

Sales:

Central North Airport Group (OMAB)

Portfolio Holdings

Canada Portfolio

Global Portfolio

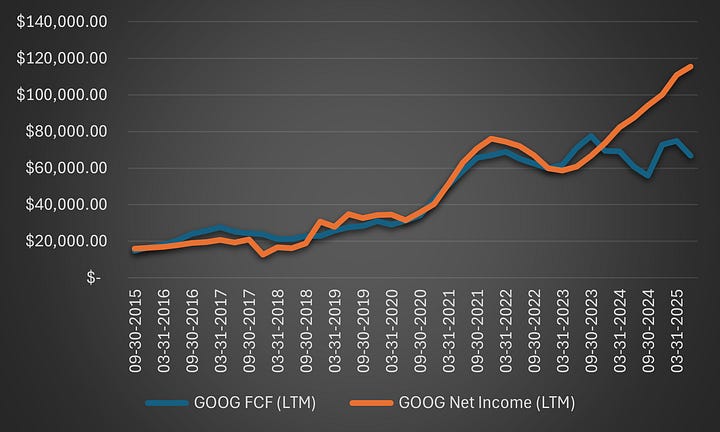

Performance

Canada Portfolio

Global Portfolio

Disclosure: I am long and have a beneficial interest in all of the above-mentioned securities. I may change my holdings at any time post-publication.

Disclaimer: This newsletter and/or any other articles that I publish should not be construed as investment advice. None of the strategies or securities mentioned should be considered as an investment recommendation to buy or sell. I am not an investment advisor, and I highly recommend that anyone considering this investment strategy or any of the securities first consult with a registered investment advisor to assess both the suitability and risk of any strategies or securities that are mentioned.