Summary: Quick trade idea. The Japanese yen is probably at its lows. And Nintendo is (likely) to launch its next-gen console the Switch 2 this year. Risks if there’s delays and to the consumer spending (due to the economy). Lastly, ~25% of the market cap is cash and investments (for good and bad).

Hi everyone,

I hope everyone had a great holiday and looking forward to 2025. Trump, the Tariff Man, is coming (back) to town next week. But I’ll have more thoughts on that later this week with an update to the Sleepy Portfolio.

Today, I just wanted to share a trade idea. It’s not going to be in-depth but thought it might be of interest. And that’s Nintendo which I’m sure everyone is familiar with. Sidenote, Nintendo was in the Sleepy Global Portfolio and one of the few winners (sidenote: I haven’t made up my mind what to do with that portfolio yet so a big chunk of it is still sitting in cash (well MTBA to be exact) which isn’t the worst thing in the world given the last month or so).

So why Nintendo? And why now?

The first reason is that from a US investor (or global investor) perspective, it would have underperformed the S&P 500 and NASDAQ over the last couple of years (not a great benchmark but that’s what everyone is focused on these days).

It’s not because the business is doing poorly, far from it.

But because the Yen has lost value to the USD. We see that the YEN has gone from ~105 Yen (to $ 1USD) to ~157 Yen to ($ 1USD) (close to a 50% depreciation over the last couple of years.

Due to the drop in the Yen, Japan is (finally) experiencing inflation (after a decade of deflation). But it’s becoming politically untenable because it’s the “bad” kind of inflation (i.e. food and energy).

So I think we’ve likely seen the bottom of the Yen. And then there’s Trump who will be putting significant additional pressure on both the Japanese and Chinese to strengthen their currencies as well.

For global equity investors, the currency will turn from a headwind into a tailwind.

But my Nintendo trade idea isn’t just a currency play.

Nintendo still has one of the most valuable intellectual property portfolios in the world (Mario, Zelda, Pokemon, Animal Crossing, etc.). And its IP franchises are about to get a big jolt from the recent news.

There have been lots of leaks recently that the Nintendo Switch 2 will be unveiled soon (although there have been predictions of a new Switch for years). The latest is that Nintendo will announce the Switch 2 as early as Thursday (January 16th) and will be released sometime in May or June.

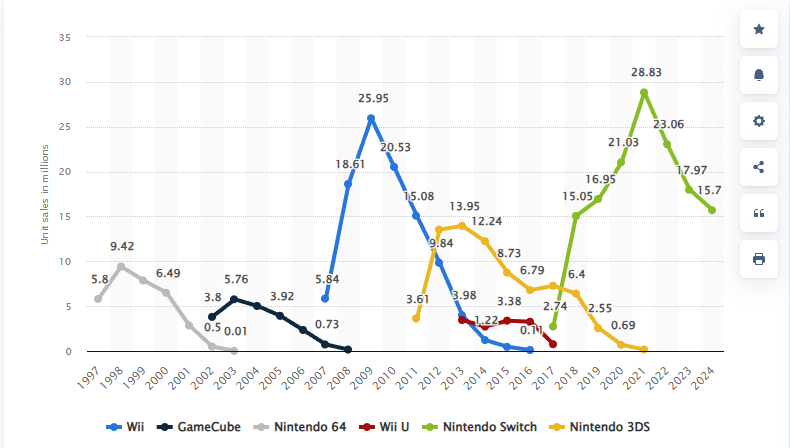

The original Nintendo Switch was released in 2017 and is one of the best-selling consoles of all time. But that was 7 years ago and it’s getting long in the tooth. Unit sales peaked during Covid and are on a terminal decline now.

The console cycle is king and a new console will not only drive hardware sales (aka consoles) but also video game sales (and future development).

You can see the impact of the console cycle on the company’s revenues which have moved in almost lockstep over the last 20 years.

And yet this news hasn’t been factored into analyst estimates (yet). As they still forecast a significant earnings drop in 2025.

It could be that analysts are pricing in a strengthening in the currency (which hurts overseas earnings when converted back into Yen). But in my opinion, the increase in revenues and profits of the Switch 2 will significantly exceed any currency impacts.

We could be looking at a situation where analysts are “chasing after” the EPS.

What are some of the downsides?

First, video games (and consoles) are still a discretionary purchase so if the global economy continues to struggle (or in a worse case situation the US joins much of the rest of the world in recession). Then sales may underwhelm (although at the same time during recessions people have more time to play games, unfortunately).

A bigger risk is that if Trump does implement tariffs. Not only will that potentially cause the cost to increase (thereby reducing demand). But it could also create chaos in the global supply chains which either delays the release of the Switch 2 or materially slows production.

Lastly, I wouldn’t say it’s a risk per se, but capital returns aren’t the greatest at Nintendo. Although given the company’s very long track record of success so it’s hard to fault them.

But if you convert their balance sheet into USD (just makes it easier), the company has a ~$68 billion market cap. Meanwhile, the company is sitting on ~$14 billion in cash and short-term investments. And another ~$3.3 billion in long-term investments.

Yes, the company is sitting on roughly 25% of its market cap in cash. They are the most cash-rich company in Japan. And have been for a very long time.

The company pays out a small variable (roughly 1.2%) but doesn’t buy back any shares. And as there company trades at a premium to book value, there’s no incentive for the company to change (unlike most Japanese companies that trade at a fraction of book value).

So you take the good with the bad.

Just to wrap up, how am I playing this trade idea? Next week is Trump’s inauguration. So if the Switch 2 is announced on Thursday, it will probably get lost in the news.

In my regular (non-registered) account, I’m sitting on a bunch of cash and will look to deploy it once we know once and for all what’s going to happen on the tariff front (for good or bad).

So probably by the end of next week, I’ll look to add to the name. And I’ll be buying the US ADR as it’s just an easier way for me to do it.

Disclosure: I am long and have a beneficial interest in all of the above-mentioned securities. I may change my holdings at any time post-publication.

Disclaimer: This newsletter and/or any other articles that I publish should not be construed as investment advice. None of the strategies or securities mentioned should be considered as an investment recommendation to buy or sell. I am not an investment advisor and I highly recommend that anyone considering this investment strategy or any of the securities first consult with a registered investment advisor to assess both the suitability and risk of any strategies or securities that are mentioned.

Thanks for this analysis. Why not Sony and Nintendo?