When a company $RUNs away from the truth

Disclosure: I am short SunRun ($RUN) and have a financial interest in the company’s share prices declining. I may change my position at any time after publication.

Hi everyone,

The markets have been very volatile and rough so far in August. But many people have written and discussed the issues so I’d like to take a moment to focus on a more esoteric company and issue.

The company in question is California-based SunRun (trades on the NASDAQ under the symbol RUN) which is involved in the residential solar industry. As I mentioned in the above disclosure, I am short the company’s shares so keep that in mind.

Over the last 3 months, the stock has rallied hard on expectations of (imminent) rate cuts. The company reported earnings last Tuesday (August 6th) after the close and the stock rallied further.

Where I take issue is in the company’s earnings release (which can be found here).

So it sounds like SunRun is a profitable and growing company right?

Well not really. At the bottom of the news release, the company also included its unaudited financial statements.

Here’s the Statement of Cash Flows so we can see where the company is generating all of this cash:

Oops, SunRun’s core operations lost $208mm in the quarter. Meanwhile, they spent another $608mm investing in the business.

So how did the company “generate” 217mm in cash in Q2?

By selling assets and issuing debt!

And this isn’t a one-off either. In the last 10 years (40 quarters), the company has generated positive operating cash flow just 2 times!

This is a business (and industry) that doesn’t generate any profit or cash.

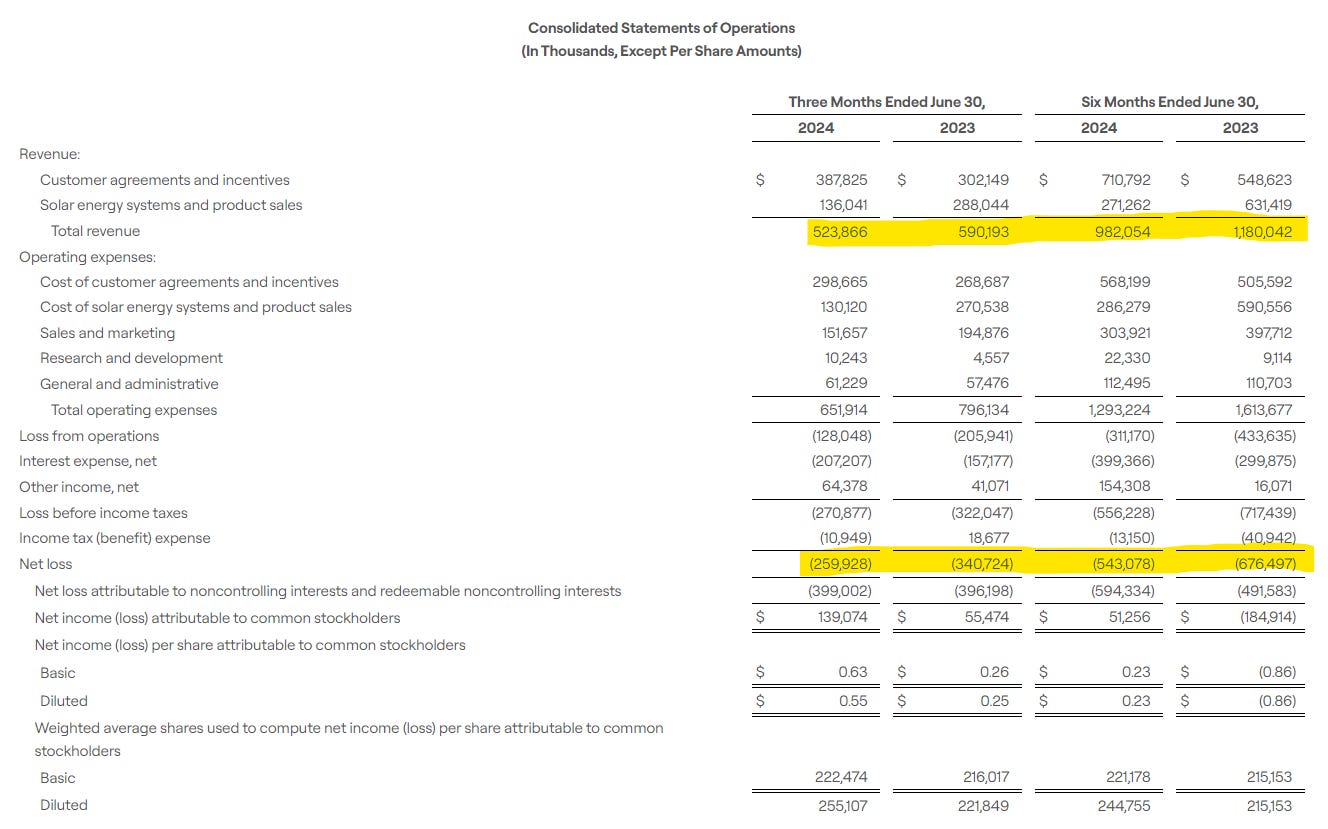

The company is also busy touting its growth. And yet again if we go back to the financial statements and this time look at the income statement we can spot something:

There is no growth. Q2 revenue is down 11% YoY and H1 2024 revenue is down 16% YoY. Hardly surprising though if you have to sell assets to stay solvent.

The one thing that is growing, and rapidly, is the share count.

SunRun’s shares outstanding have increased from 96.73mm to 223.5mm today (and 255mm on a fully diluted basis) over the last ten years.

We’re now almost halfway through Q3 and we know:

A) The underlying business burns through ~800mm to ~$1 billion in cash each quarter (regardless of what management says).

B) There’s only about $1 billion in cash (and restricted cash) on the balance sheet.

C) Net debt stands at close to $12 billion (versus a market cap of $4 billion) which limits how much more they can raise to hit their “cash generation” targets.

So I expect the company to start selling equity (again). And aggressively before the end of the quarter (my baseline assumption was that they would start issuing the equity at the first chance last week but was wrong).

So in summary, it’s an unprofitable and cash-burning business that is way overindebted and likely headed to bankruptcy (one of its competitors SunPower just filed for bankruptcy).

It’s a free market so I don’t have a problem with bad businesses going public. Or with people investing in bad businesses. But where I draw the line is when companies claim to be something they are not (and this is a pretty egregious case).

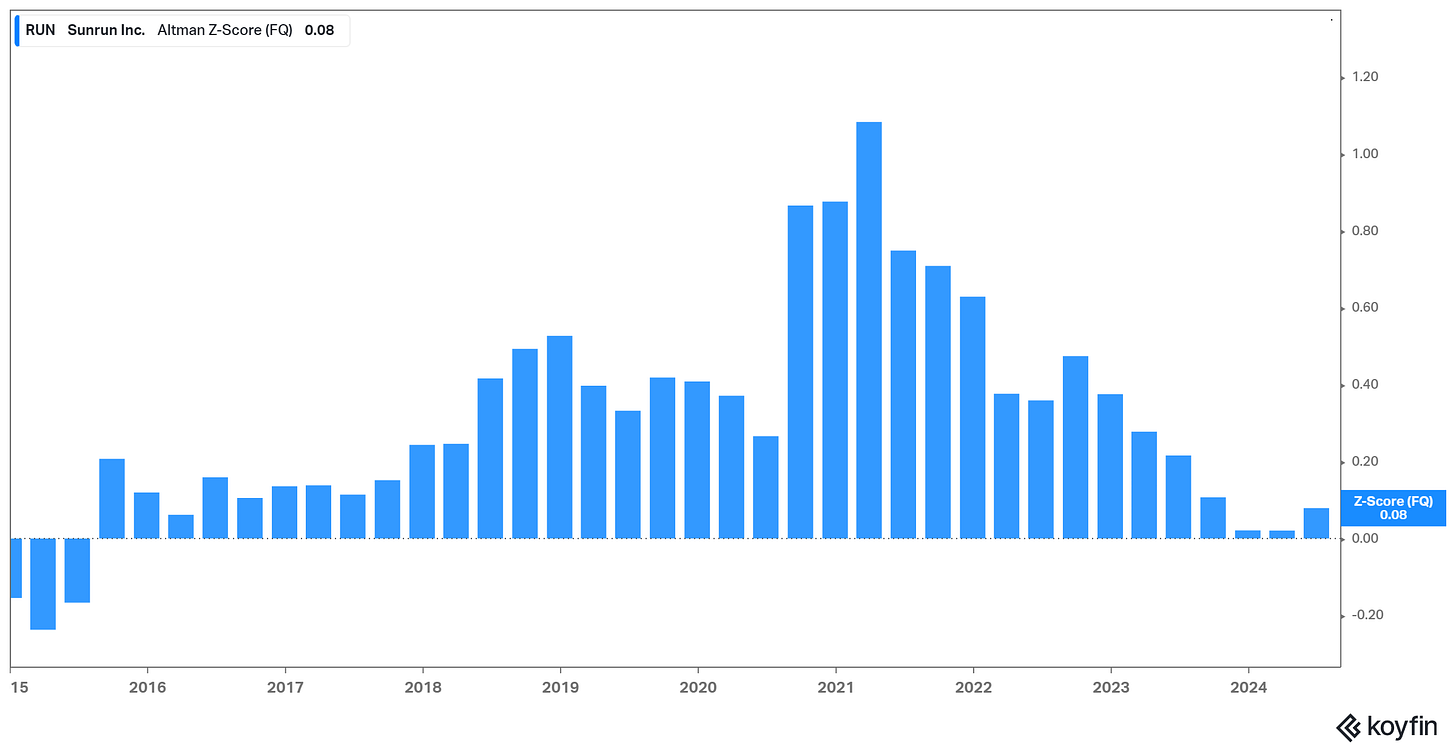

If we look at the Altman Z-Score, a well-known bankruptcy prediction model.

Anything over 3 means a low risk of bankruptcy. Between 1.8 and 3 bankruptcy risk is elevated. And anything under 1.8 means a high risk of bankruptcy.

So the company is likely to be headed to bankruptcy eventually, the only issue is timing (and depending on how much equity the company can sell to forestall it).

Beyond the company being a shitco, there are a couple of overarching themes that I wanted to touch on.

Where is the SEC? When WeWork tried to go public (the first time), everyone mocked their non-GAAP / pro-forma “community adjusted EBITDA”. And yet nowadays the use of these pro-forma metrics has become the norm. SunRun isn’t the only one that is using these non-GAAP metrics to completely warp how their business is performing.

Bloomberg’s Matt Levine often tongue in cheek refers to “everything as securities fraud”. I’m no lawyer, and definitely not a securities lawyer. But you have to ask yourself, where is the line? If a company through its normal operations burns through $800mm in cash and then claims to be “cash generative”. Does anything matter?

I also worry that as the economy slows and share prices come under pressure. We’ll see a lot more of this as executives are under pressure to keep share prices elevated. With lax (or non-existent) enforcement of securities laws and huge incentives, we could see a huge corporate fraud wave similar to the end of the Dotcom bubble (Enron, Worldcom, etc.)

IWM over SPY. The Russell 2000, which broadly represents US small-cap companies and is often referred to by the ticker as the iShares Russell 2000 ETF, has badly underperformed the S&P 500 (SPY) since the GFC.

But when you look within the indices, it’s not that hard to understand why. IWM is choked full of garbage like SunRun. The S&P 500 has become very top-heavy due to the Mag7 and I have my qualms about the valuations (and Tesla in general).

But at least these are (possibly) the greatest companies that have ever existed (in terms of profitability). Is Apple (for example) overvalued at ~33x earnings? Probably, but the company makes so much money and is relentless in repurchasing shares.

So it might go down say 20% in a market correction, and possibly more in a recession. But at least you know that the underlying business is very solid so there’s a fundamental floor to the share price.

The same can’t be said for SunRun and many other names in the Russell 2000. Many will likely go to zero. Which is why I think there’s a good chance that the IWM will continue to underperform (on a relative basis) the S&P 500 over the next 2 to 3 years.

So thanks for taking the time to read this and stay safe in these markets.

Disclosure: I am short and have a beneficial interest in all of the above-mentioned securities. I may change my holdings at any time post-publication.

Disclaimer: This newsletter and/or any other articles that I publish should not be construed as investment advice. None of the strategies or securities mentioned should be considered as an investment recommendation to buy or sell. I am not an investment advisor and I highly recommend that anyone considering this investment strategy or any of the securities first consult with a registered investment advisor to assess both the suitability and risk of any strategies or securities that are mentioned.\