Hi everyone,

Just a disclaimer before I start, this will likely be my most controversial post and emotions are already running high. So if you disagree with my thoughts/views, that’s fine. The beauty of markets is that you can express your view in any form there. Let’s all keep it civil.

As I hinted in my Vinci trade idea (found here), I’ve decided to sell all of my US equities. I’m making the bold (and risky) call that the massive outperformance we’ve seen from US equities since the bottom of the GFC (global financial crisis) is over.

Not only do I think global equities will outperform US equities over the next 5 to 10 years. I think there are good odds that US equities could be flat to down (just like in the 1970s and 2000s).

Admittedly, I thought the US equity run ended in 2021 with the SPAC and crypto mania. I drastically underestimated how far the “AI” bubble would give new life to the “animal spirits”. And nobody saw Russia’s invasion of Ukraine which has hobbled Europe (economically and politically). But maybe 2nd time is a charm.

What is driving my views? I think US equities have an economic and political problem.

Let’s start with the economic problem, which is the “AI” bubble.

The hyperscalers (Microsoft, Google, Facebook/Meta, Amazon & OpenAi) are spending like there’s no tomorrow. The companies have given their 2025 CAPEX (capital expenditure) guidance. For 2025, Amazon will be spending $100-105 billion, Microsoft will be spending $80-$85 billion, Google will be spending $75 billion and Facebook will be spending $65 billion.

That’s over $300 billion from these 4 companies alone. All told, US CAPEX on “AI” is likely to exceed $500 billion this year.

So what’s the problem with all of this spending?

So far “AI” has generated negligible amounts of revenue. If you’re spending lots of money on one side of the ledger while no money comes in on the other side, you’ve got a problem.

They have been able to avoid the hit to earnings thanks to depreciation and amortization. Meanwhile, their suppliers (Nvidia, Broadcom, SuperMicro, etc.) can recognize the revenue and profits immediately.

Accrual accounting isn’t some nefarious thing. Expensing large capital investments over time has been a core part of accounting for hundreds of years.

But the hyperscalers are already messing around with the depreciation schedules to push the earnings hit even further into the future (a tacit admittance that there’s a problem). Much of this “AI” equipment (chips, racks, etc.) lasts 3 years (at best). And yet the Hyperscalers have increased the time it takes to write down their investments from 3 years to 4 years to now 5 years (Amazon is leading the pack at 6 years).

Using Microsoft for example, you can see how earnings yield and free cash flow yield have diverged ever since the “AI” capex boom took off starting in 2022.

These accounting games can only go so far and eventually, the pain will come. But if you want a more detailed write-up on big tech’s declining earnings quality here. .

None of this would be an issue if the companies could monetize (i.e. generate revenue) from their “AI” endeavors. And yet I’m struck by the speed at which LLMs (large language models) have become commoditized and have zero moat.

I’ve tried all of them (ChatGPT, Bard, DeepSeek, Le Chat, etc.). Each has its strengths and weaknesses, but I would be hard-pressed to tell one from the other. And there’s zero switching cost for consumers.

The hyperscalers are stuck in an arms race that they simply can’t win. Evoking the Red Queen’s race from Lewis Caroroll’s sequel to Alice in Wonderland:

"Well, in our country," said Alice, still panting a little, "you'd generally get to somewhere else—if you run very fast for a long time, as we've been doing."

"A slow sort of country!" said the Queen. "Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!"

And things aren’t going better on the business sales side. Here is Alibaba’s Chairman Joe Tsai and I highly recommend watching (I start the video halfway and the relevant part is about 4 minutes long):

Joe equates cutting-edge LLMs with getting PhDs and pursuing Nobel prizes. Which he (very politely) describes as a waste of time and resources. But why?

Having “AI” models that know everything doesn’t necessarily make it useful for businesses. If you’re a company and you want an “AI” chatbot for basic customer service tasks. Does knowing all of the world’s history help? No.

If you want an “AI” program that helps with HR policy tracking and implementation, does knowing all of the literature in recorded history help? Again no.

And even if these models work, is it practical and make economic sense? Probably not. It’s like designing and building a car that has 5,000hp, even though it will never go faster than 5mph. Maybe it’ll work, but it’s ill-suited for the task and will lose to a machine purpose-built for that specific task.

And this is why he says “AI” should be focused on solving real-world problems.

Lastly, “AI”s legal problems aren’t going away either. It slipped under the radar but last week Thomson Reuters won a landmark AI copyright case. Not that this should be at all surprising given that copyright law is well established.

But AI’s legal problems are very real and not going away. All of these Hyperscalers have scrubbed the entire internet for data without any authorization or approval from intellectual property rights holders.

I have no idea how much the litigation and settlements will cost. But it will be expensive. And this only further erodes the economics and profitability of “AI”.

So when you add it all up, I think this frenzy to pour money into “AI” (in my opinion) will go down as one of the great boondoggles of history. The best comparison is the frantic buildout of fiber optics during the dotcom bubble as everyone (at the time) extrapolated far greater levels of demand than was realized.

While most of the fiber optics industry went bankrupt after the dotcom bubble popped (due to high debts). The current hyperscalers still have pristine balance sheets and generate prodigious amounts of cash. So bankruptcy is not a concern. But that still doesn’t mean their stock prices can’t fall.

The hit to earnings will be large, and the company’s management team’s credibility will also take a hit. It was only a couple of years ago when Mark Zuckerberg’s Facebook poured tens of billions into his metaverse project. Meta’s share price fell almost ~75% from peak to trough before the company gave up on the venture.

We could see a similar reaction to the hyperscalers as they continue to pour hundreds of billions into “AI” with deteriorating economics and no prospect of profits anytime soon. A 75% decline is very extreme, probably more like a 20% to 30% decline, but given their outsized weight in the S&P and NASDAQ index, the pain will be felt.

And then we get to the politics, the Elephant in the room.

Trump has been president for less than a month and already things are going off the rails. Contrary to expectations (or hopes), this time around is going to be very different from his first term in office.

Look no further than his nominees. Tulsi Gabbard and RFK are both completely unfit for office and should have never been within 100 miles of any position of power and authority. And yet not only did Trump nominate them, but a Republican majority senate confirmed them.

They aren’t the only ones either. Kash Patel, the nominee for FBI director, has already been caught receiving millions in bribes (including from Trump’s media company), and yet looks like he’ll be confirmed regardless.

Secretary of Defense, Pete Hegseth, promised to refrain from drinking while on the job (due to alleged issues with alcoholism). And yet at the latest Nato summit was caught drinking a suspiciously brown liquid on air while taking questions.

None of this compares with what happened to NYC Mayor Eric Adams. Adams was caught red-handed accepting bribes from Turkey. As a hail Mary to avoid prison, Adams cut a deal with Trump to avoid prosecution if he helped Trump with ICE deportations. Completely unethical and illegal.

This led to the standoff in the Department of Justice with half a dozen prosecutors resigning rather than dropping the charges. And forced the Deputy AG into locking all of the prosecutors in a room and demanding one of them drop the charges or they would all be fired.

The charges were finally dropped and Adams appeared on live TV with border Tzar Tom Homan who made little effort to hide the quid pro quo of the whole escapade.

So much for law and order, eh?

And then we come to Elon Musk and his DOGE group of clowns. I’ve written in the past my dislike of Elon Musk but at least he’s consistent. The lies and haphazard management are nothing new to anyone who’s followed him throughout his career.

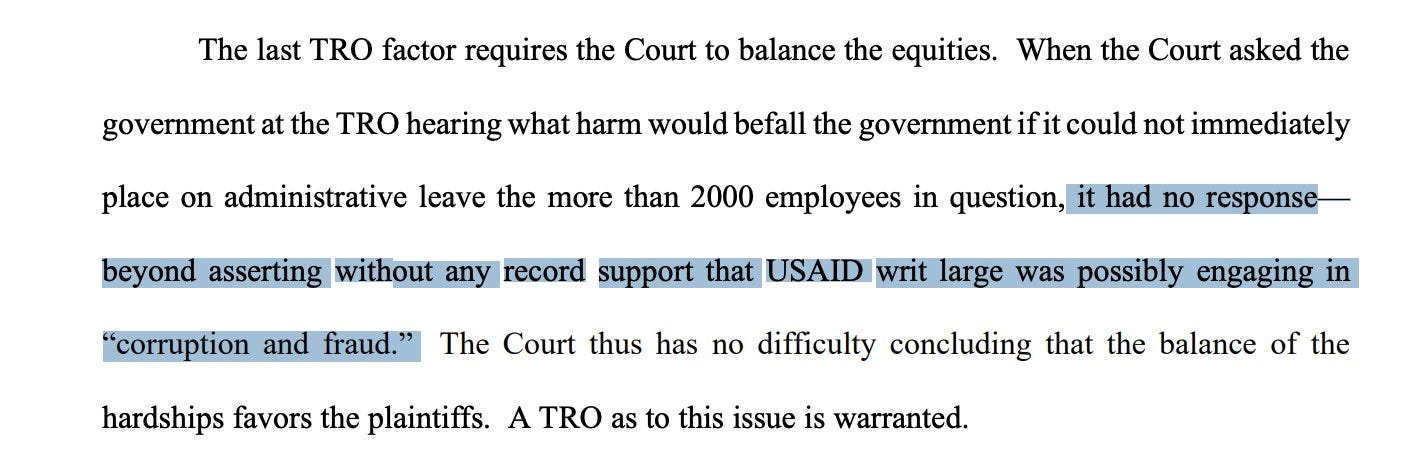

Elon has been making big claims of finding “corruption and fraud” (for instance in USAID), and yet when under oath and in court government lawyers were unable to point to a single instance of either.

Elon has now moved on to claiming “massive” amounts of corruption in the Social Security system. It turns out that it’s likely he and his staff have no idea how the COBOL system works and are misinterpreting how works (possibly deliberately).

It’s pretty clear now that Elon is equating anything he or Trump doesn’t like as being proof of fraud or corruption. It’s a ridiculous argument but it plays well to the MAGA faithful.

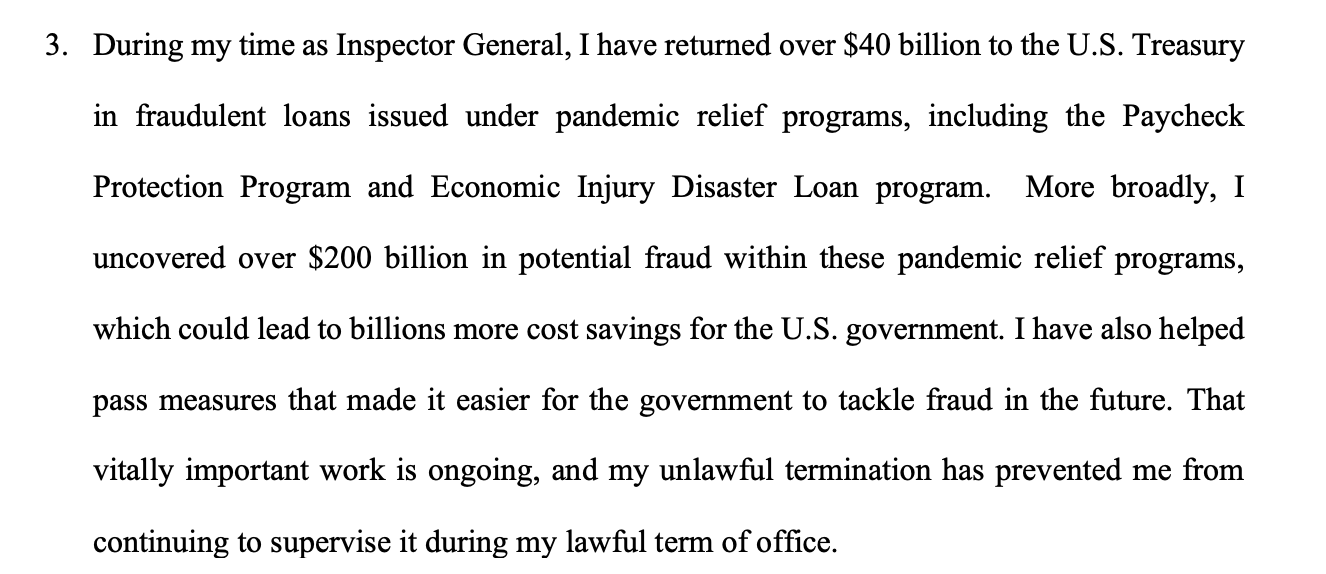

If they were serious about rooting out corruption, waste, and fraud. Trump wouldn’t have fired more than a dozen inspector generals (the independent government auditors) as one of his first actions as President.

Here is the testimony of one such Inspector General that was fired:

He’s also brought his “Twitter chainsaw” to the US government and is haphazardly cutting staff wherever he can. Last week we got this incredible headline:

Trump officials fired nuclear staff not realizing they oversee the country’s weapons stockpile, sources say

Because firing the people who secure and maintain your nuclear weapons should be a priority (sarcasm warning)? Government officials then had to scramble to rehire all of the staff (for obvious reasons).

This week, they’re busy firing hundreds of FAA technicians and engineers who maintain the country’s aviation systems that keep the skies safe. Just as we see a big uptick in airplane crashes and other flight safety mishaps.

There is a fundamental difference between running a business and government. “Move fast and break things” is Silicon Valley’s mantra. And that’s fine if you're an inconsequential tech company. But that doesn’t work for governments.

The world won’t stop if Twitter’s servers crash and go offline for a couple of hours. But the same “modus operandi” can’t be applied to government where there are very real economic and social costs to a failure to deliver services

And I think it’s coming. Treasury Secretary Scott Bessent has conceded his role to Elon. DOGE now has complete access to the Treasury payments system and more alarming, they are making changes to the code base without any testing or quality control (absolute madness).

This is making treasury officials “very nervous” and yet nobody knows (or is willing to say) what exactly these code changes are meant to do. But when something does break (either intentionally or not), all hell with break loose.

I could go on, but it’s only been three weeks, and shows no signs of improving. In short, the US is turning into a banana republic. We can debate the political implications another time.

From a market’s perspective, banana republics don’t trade at 22x or 25x earnings. They trade in the single digits (just ask LATAM investors).

This revaluation won’t happen overnight but will likely be gradual and happen over years. If I’m right (which is still a big if), foreigners will be the first to sell. Both given the relative valuations as well as social/political pressure to bring capital back home.

What would that look like? Consider Canada and its big pension funds. Right now the US isn’t popular here and there’s already growing pressure for these big funds which have ~40%-50% of the assets in the US (public equities, fixed income, private assets, etc.) to divest.

And we’re talking big dollars. The big Canadian pension funds; CPPIB (~$700b AUM), Caisse (~$450b), AIMCO (~$170b), PSP (~$265b), Ontario Teachers (~$260b), OMERS ( ~$130b), HOOPP (~$112b) and BCI (~$250b) collectively have close to C$2.5 trillion in assets.

Throw in European and Asian institutional investors like Norway’s oil fund, Singapore’s GIC, and Japan’s GPIF. All of a sudden you’re talking about trillions of dollars that may for one reason or another be looking for the exit door. But these giants are like supertankers that don’t turn around and change course quickly. It would be a slow and gradual process.

This wouldn’t be a problem except that based on the data, everyone (both American and foreign investors) are all in on US markets. So it begs the question, who will be left to buy? Probably not retail as they’ve shown to be momentum investors (i.e. chase performance).

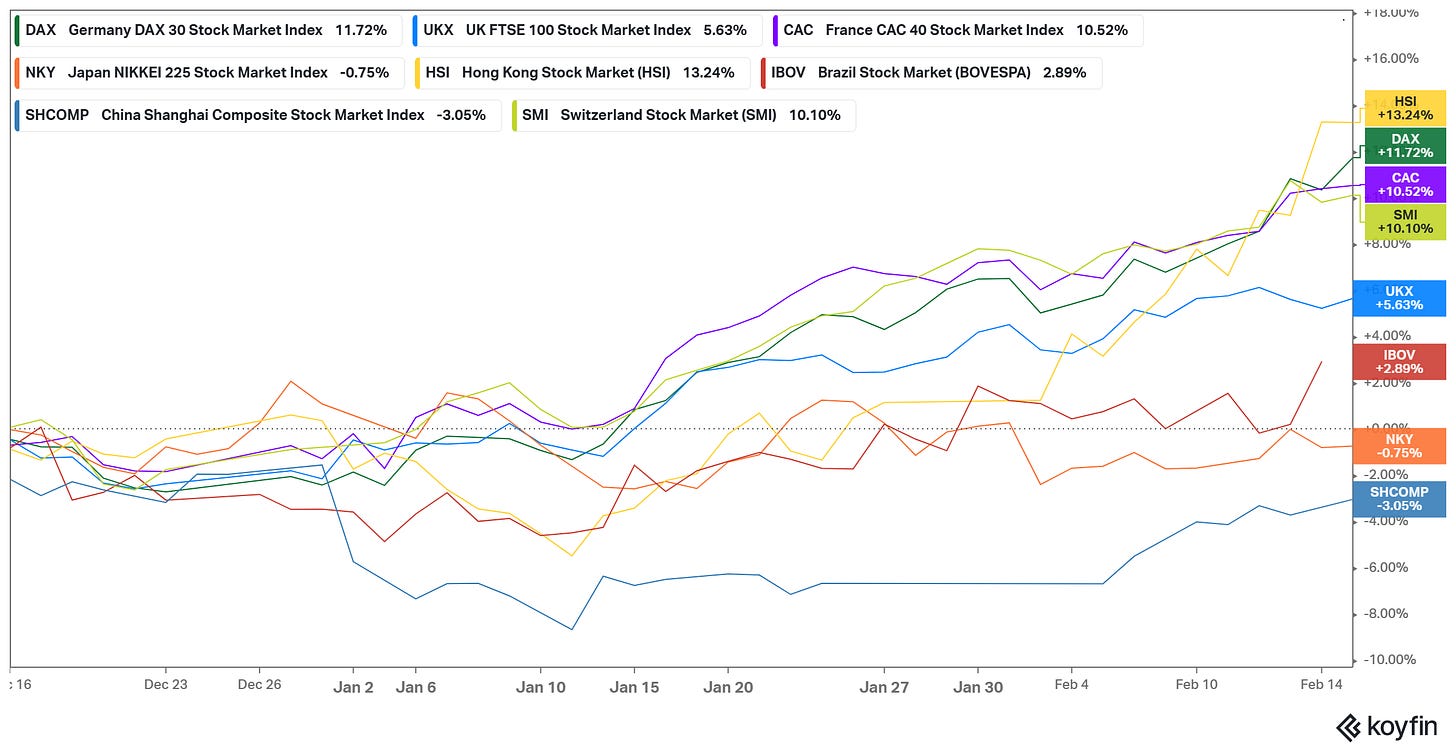

Maybe it’s already happening? US markets rallied on Trump’s election victory but have gone sideways since mid-December (I’m including Bitcoin as a US asset).

Meanwhile, lots of markets, particularly in Europe, have significantly outperformed.

It’s a very tiny sample period (2 months), but maybe the rotation is already underway.

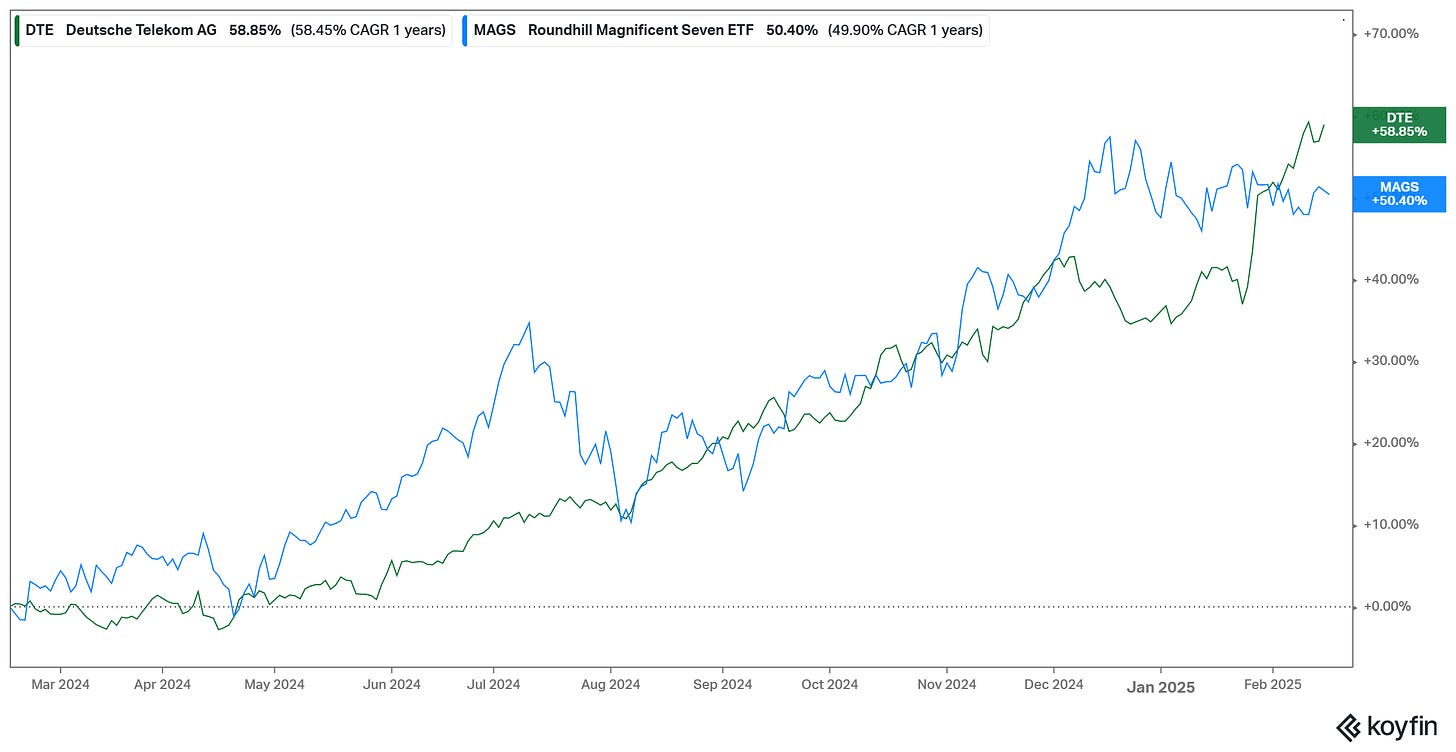

Here’s a funny chart. Who’d have guessed that sleepy old Deutsche Telekom would be outperforming the Mag7 not just over the last 3 months but the last year?

So to sum up and review. US earnings will likely be under pressure for years to come. That is unless the mega-cap tech companies find some way to monetize all of their “AI” spending.

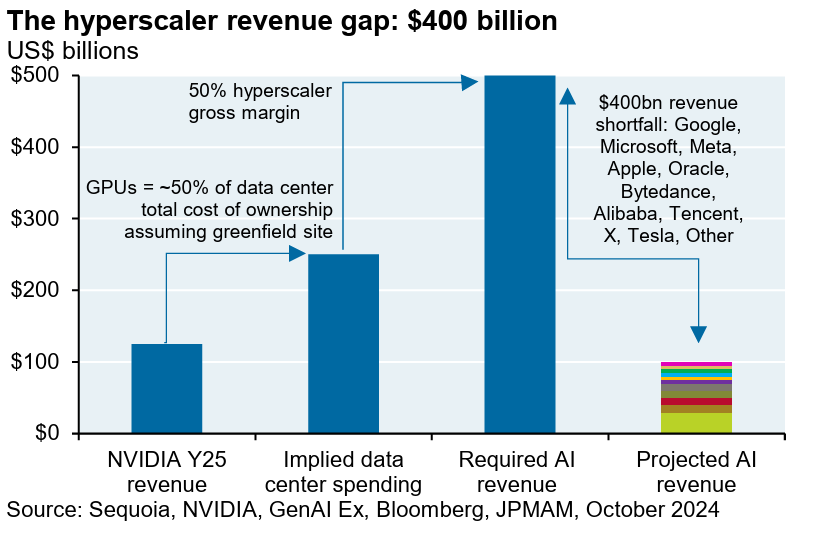

I’ve probably highlighted this chart before, but it remains one of my favorite showing the “AI gap” from JP Morgan’s Michael Cembalest:

At the same time, the US is turning into a banana republic. And at a time when it’s valuation relative to the rest of the world is the highest in history. The US markets won’t crash, but the persistent selling will compress the valuation and US equities could be facing another lost decade.

Here too I could be wrong. Maybe I’m overreacting and Trump slashing government bureaucracy and red tape “unleashes” America. Undoing a lot of the burdensome banking regulations unleashes a lending spigot that lets US businesses soar.

(Although the current America made the US the largest oil producer in the world and world leader in technology.)

Lastly, nothing is set in stone either. Opinions and views can and should change over time. So I’ll be constantly re-assessing if this (bold) call was right or not.

Disclaimer: This newsletter and/or any other articles that I publish should not be construed as investment advice. None of the strategies or securities mentioned should be considered as an investment recommendation to buy or sell. I am not an investment advisor and I highly recommend that anyone considering this investment strategy or any of the securities first consult with a registered investment advisor to assess both the suitability and risk of any strategies or securities that are mentioned.

Thanks for sharing, interesting thesis. How do you square your concerns re: US equities vs Equity PM's being benchmarked to the S&P500? This isn't going to change any time soon...