Trade Idea: Vinci SA (FR:DG / US:VCISY)

Hi everyone,

I’m back with another trade idea. My last one, Nintendo (can be found here) has been working out pretty well so far so I decided to do another.

I’ve started looking in Europe and Asia for high-quality compounders because I’ve decided to sell all my US equities.

I’ll dive into my rationale next week with the Sleepy Portfolio update but just wanted to highlight one company that I came across that looked promising.

And that’s French construction and engineering conglomerate Vinci S.A. While you may not be familiar with the company, it’s the world’s largest engineering and construction company in the world (at least by market cap).

I know what you’re thinking, eeewww French stocks. And the stock price reflects that.

The stock is only slightly up over the last 5 years while the Canadian firms have had a decent return and US firms have soared.

Top-down, the fundamentals don’t justify the underperformance.

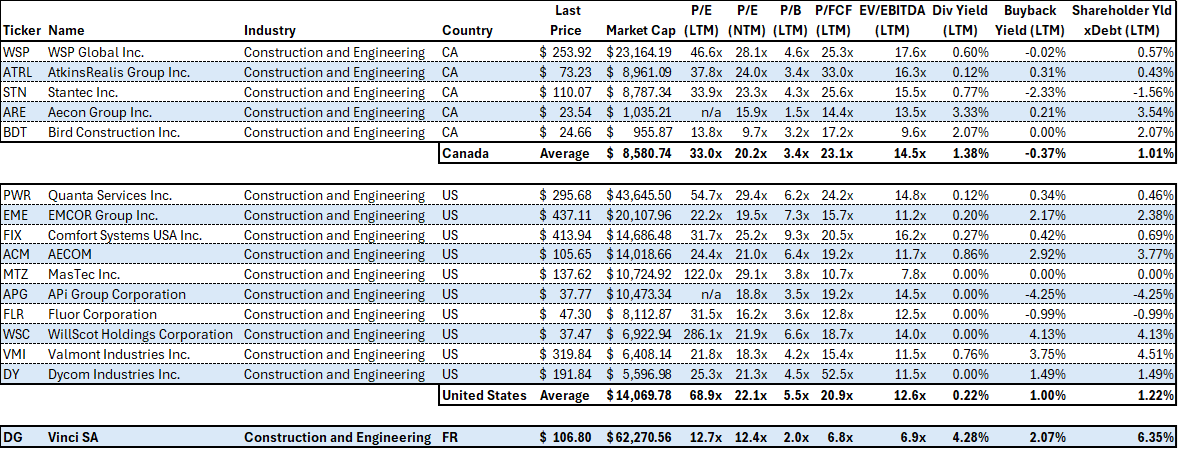

Here I compare Vinci with the big 5 Canadian construction and engineering firms Canadian investors will be familiar with. And the ten biggest US firms (by market cap).

The US firms in aggregate have grown rapidly, but that makes sense with how strong the US economy has been (and the AI capex boom).

But Vinci has managed to grow high single digits and roughly at the same pace as the Canadian firms while being significantly more profitable. And that’s with the European economy sucking wind for a decade.

And yet the company’s valuation is a fraction of its US and Canadian peers.

The company trades at roughly a 50 to 65% discount (depending on the measure). Even as it returns significantly more capital to shareholders.

Its Canadian and US peers have seen their valuations expand. Vinci has seen its valuation compressed. On almost all valuation metrics, Vinci’s valuation is now in the bottom quartile versus its 10-year history.

This chart is messy, but using the price to book (the others show roughly the same story) Vinci’s valuation has compressed from 2.6x to 2x while most others have doubled (or more).

While investors can only see downsides to Europe. Things only need to get less bad (famous last words) for Vinci’s stock to play catch-up. And looking forward, things may not be so rosy for the US. President Trump & Musk are talking about significant budget cuts and (short-term) economic hardship.

The US engineering firms have also been big beneficiaries of the AI bubble. And it shows in the fundamentals and stock price. But I wonder how long it will last.

This year the big 4 hyperscalers (Amazon, Microsoft, Google & Meta) alone are guiding to spend $330 billion on AI capex. But with the emergence of overseas rivals like DeepSeek and Mistral are significantly more efficient. I wonder how long these companies can maintain this level of spending.

But enough about that, so what exactly is Vinci SA? As I mentioned it’s a French construction and engineering conglomerate with four core groups:

Vinci Construction (goes without saying)

Vinci Concessions which is further broken down into Vinci Autoroutes, Vinci Highways, and Vinci Airports.

Vinci Energies

Cobra IS

There are a couple of other ancillary businesses but they don’t move the needle.

The Construction arm is pretty self-explanatory. It’s a low-growth and low-margin business, but the order book continues to grow. And it’s often used as a pipeline to drop down assets into its concessions business.

Cobra IS and Vinci Energies are two separate but very similar businesses focused on the renewables and power industry. Cobra IS is relatively new as it was a joint venture with Spanish construction company ACS started in 2021.

Cobra IS is much more focused on Spain and South America and on developing renewable power projects, transmission lines, substations, etc.

Vinci Energies is more global and mainly focused on modernizing and refurbishing buildings and other infrastructure to be more energy efficient.

The margins on both businesses aren’t great but better than the construction group. I’m honestly not thrilled about Cobra IS, especially as the world pulls back from the “green frenzy” we’ve seen over the last couple of years. But at least it’s a profitable business, unlike many renewables companies.

I do like Vinci Energies business and I think there’s a massive business opportunity to refurbish buildings all across the world and will likely last for decades to come.

Lastly, there’s Vinci’s concessions group which are its crown jewels.

Within its concession business, there’s Vinci Autoroutes. Which is Vinci’s legacy French toll roads, ASF & Cofiroute.

Then there’s Vinci Highways which are the rest of their concessions on roads, highways, and tunnels outside

And then there is Vinci Airport whereby they own and/or operate dozens of airports across the world. The most prominent is of course London’s Gatwick. They’ve continued to funnel excess cashflow into building out this business with recent acquisitions such as Edinburg airport.

They also have a minority ownership interest in Mexico’s OMA which I’ve written about a great deal before and own in the Sleepy Global Portfolio.

Vinci has another concession group focused on stadiums and railways but it’s not material.

To give a sense of how valuable the concession business is. It generates ~16% of the group’s total revenues and close to 65% of profits.

While the Construction group has a ~4% EBIT margin and Cobra IS and Energies have a ~7% margin. The concessions group has close to a 50% EBIT margin.

So what’s the downsides? Well obviously for one it’s a European stock (and French). Roughly a third of the company’s revenues come from France and another 40% from the rest of Europe.

And France isn’t doing so well right now. With the far left, centrists, and the far right each having roughly one-third of the National Assembly (their parliament). To say the (political) situation is unstable would be an understatement.

But it’s unlikely that France will see another election until 2027 and if the economy starts to improve, the political situation will likely follow as well.

Vinci has actively sought to diversify its revenue outside of France (and Europe) to varying degrees of success. 10 years ago, almost 50% of its revenue was derived from France.

Another negative is the conglomerate nature of the business which is very much out of style. It would be nice if they got rid of some of their small/non-material businesses to free up capital for better uses. But Vinci has historically made its unwieldy conglomerate work and it’s not about to change any time soon. You just have to accept it as an investor.

So what could it be worth? Well in 2024 Vinci generated €8.43 of earnings per share. Over the last 10 years, they’ve grown net income by 8% (and FCF by 12%) so if we assume they can maintain this level of growth for the next 5 years gets you to ~€12.40 a share.

Historically this is a company that’s traded between 16x and 18x earnings. At 16x earnings and using a 10% discount rate (just as a baseline) the company is worth ~€123/share and at 18x ~€138/share.

And then you collect dividends along the way. The company has grown the dividend at close to a 10% CAGR over the last decade. I think it’s too aggressive so let’s say the dividend grows at the same rate as net income (8%). Then the total value is somewhere between ~€145/share and ~€160/share (discounted back to today).

Alternatively, that works to a ~17.5% to 20% IRR over 5 years (if I’m right).

Maybe not enough for US investors used to tech stonk returns, but I think that’s pretty decent.

Where could I go wrong? Well if the world tips further into a recession, their business will be hit hard.

Another risk (and quite possible) is that Europe remains a dysfunctional mess, so growth remains low and the company’s valuation never re-rates.

Lastly, wow will I be investing in the company? I’m looking to buy the US OTC traded ADR $VCISY (each ADR represents 1/4th of a share in Vinci). I’m hoping for a short-term dip in the share price back down to $USD26/share (the stock is currently trading around $USD28/share).

And if it doesn’t get there by the end of the month, then I’ll just pull the trigger at whatever the price is at the time.

Thanks for taking the time and stay safe out there.

Disclosure: I am long and have a beneficial interest in all of the above-mentioned securities. I may change my holdings at any time post-publication.

Disclaimer: This newsletter and/or any other articles that I publish should not be construed as investment advice. None of the strategies or securities mentioned should be considered as an investment recommendation to buy or sell. I am not an investment advisor and I highly recommend that anyone considering this investment strategy or any of the securities first consult with a registered investment advisor to assess both the suitability and risk of any strategies or securities that are mentioned.