Hi everyone,

Spring is almost here and it’s been a month since I wrote to sell all US assets as it was turning into a banana republic.

The markets seem to have started to take notice as many markets left for dead have been having a great month while US stocks struggle.

I’ve already heard some strategists and analysts compare this period of market weakness as an opportunity to buy akin to the depths of the GFC (global financial crisis) and Covid pandemic.

But I’ll double down here and say that if you still hold US assets, sell them now. Things haven’t gotten better over the last month. In fact, they’ve continued to get worse. The US is heading towards a constitutional crisis and markets (and pundits) seem to be largely unaware.

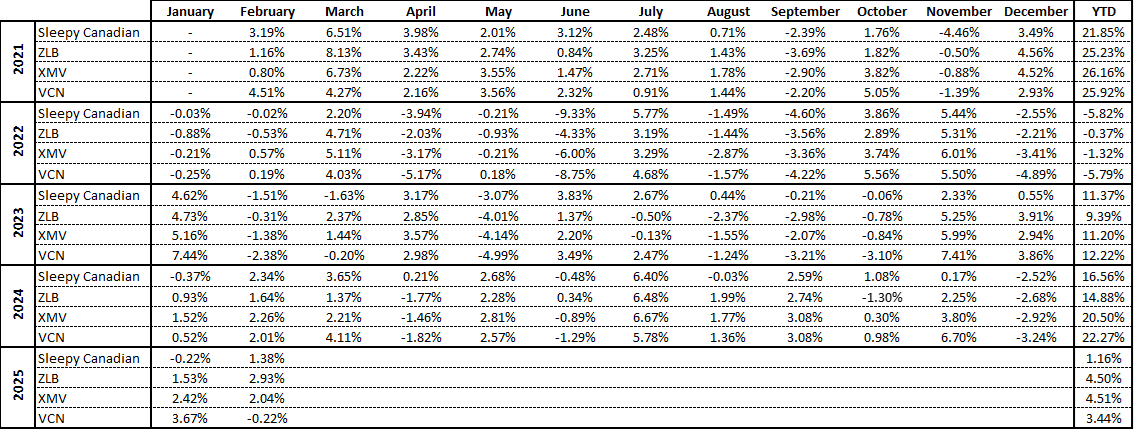

As is always the case in markets, I threw in the towel on the Sleepy Portfolio last November. Which was pretty much the bottom (performance-wise). I’ve continued to try tweaking and changing it before bringing it back and for a while, it was sitting on 30% cash (from selling the US investments).

Over the last month or so I’ve added three positions and in hindsight, I should have done a write-up for them. I added the French construction and engineering firm Vinci S.A. that I wrote about (which you can find here).

I also added Brazilian mining giant Vale on one of its many pullbacks and British industrials company Spirax Group (Australian hedge fund manager John Hempton did a far better write-up on the name than I ever could here).

That still leaves 15% in cash and I’m going to add the following three names.

Columbian oil and gas company Ecopetrol S.A. (EC), Swiss pharmaceutical company Novartis (NVS), and Japanese heavy industrials Komatsu Ltd (KMTUY).

The question now is timing and I’m torn. Markets outside of the US are running so it feels like the longer I wait, the more I miss.

On the other hand, Trump’s much-vaunted tariff report is supposed to come out sometime at the end of March / early April may will likely bring about a lot of volatility and sell-off. Although Treasury Secretary Scott Bessentt seems to be already walking back the tariffs (even before they’ve been released).

We’re only two weeks away so I think I’ll hold off (for now) and come rain or shine the account will be fully invested by early April.

On the Canadian side, I’m still sitting at 10% in cash which I’ll look to deploy at the end of the month as well. There is one small change in the portfolio this month. That is to sell Pembina (PPL) and double the weighting to 10% in Whitecap Resources (WCP).

Whitecap announced it would be acquiring Veren (previously Crescent Point). A deal investors have been discussing for years, and the stock was hit hard. I missed the bottom as the stock has bounced back some but I’m still a long-term believer in the company and its steady growth.

Now on to the main topic of this month and that’s oil. Everyone knows that I’ve been an oil bull (to varying degrees) over the last couple of years.

But so far this year it’s been a rough ride with 8 consecutive down weeks.

I still think that fair value is somewhere between $75/bbl and $85/bbl (using WTI).

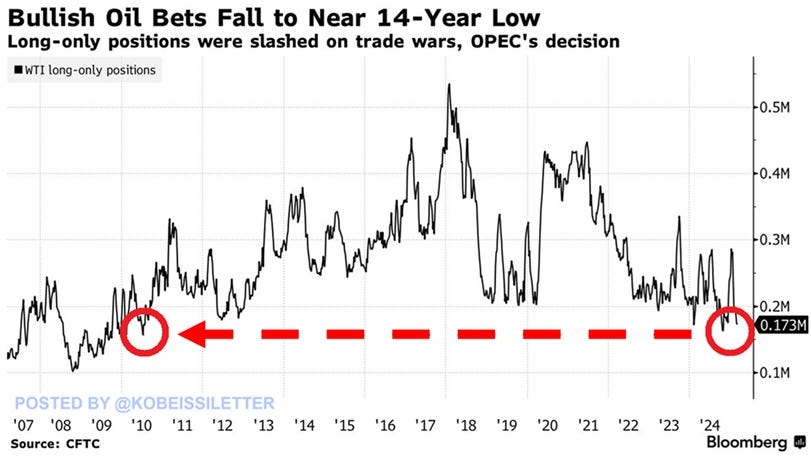

But I’m very much in the minority here though. Goldman Sachs runs surveys of their clients’ views and they found that investors are as bearish oil now as during the depths of the Covid pandemic (when the entire economy was shut down).

And this very negative sentiment is reflected in the futures positioning data.

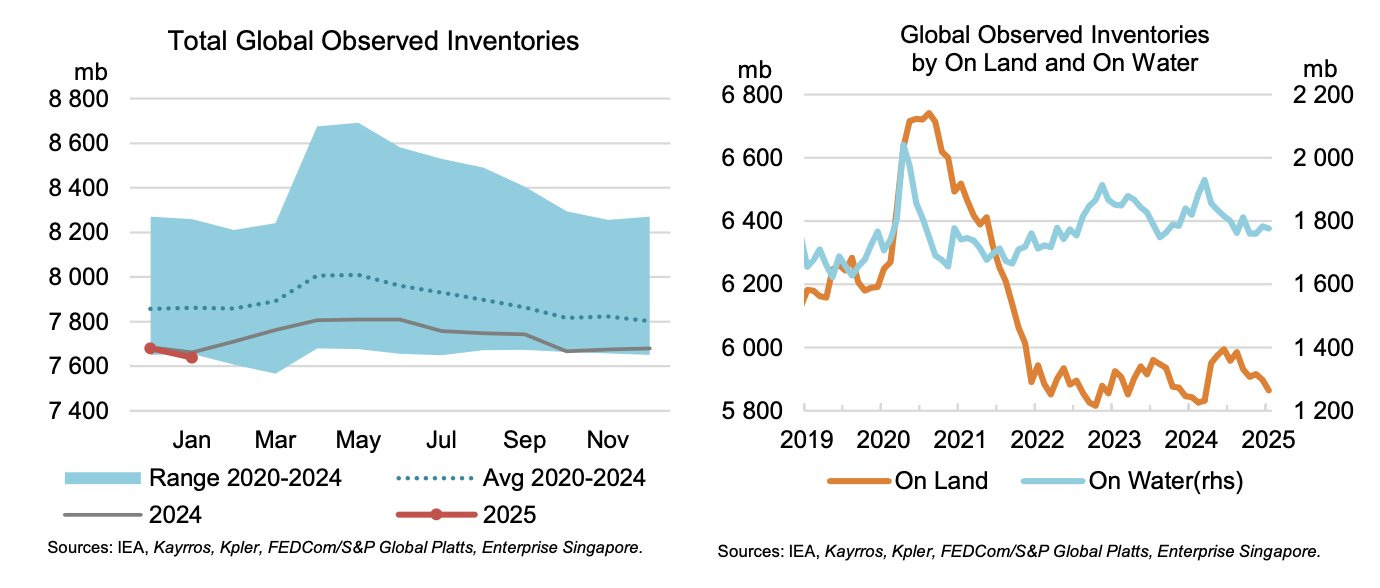

Meanwhile, we are leaving winter (often called “build season”) with no builds and ominously total observable inventories are at the bottom of both 5-year and 10-year ranges.

So if the fundamentals don’t materially start to break down, I think we can expect a quick $5-$10/bbl snapback in prices.

But what about Trump? Trump wants oil at $50/bbl.

The de facto policy of every US President for the last 100+ years is lower oil prices. Of course, they don’t always get what they want (ask Jimmy Carter or George W Bush).

Trump is just much more open and public about it than most. Don’t for a second think Joe Bidden or Obama weren’t browbeating the Saudis and OPEC every day they were in office (albeit behind closed doors).

Secretary of Treasury Scott Bessentt proposed the “3 Arrows” (3% GDP growth, 3% budget deficit, and 3mm oil production growth). And yet Trump’s tariffs are going to do the opposite.

For instance, the steel and aluminum tariffs are a big blow to the industry and will raise the breakeven cost. Meanwhile, layoffs at the US Department of Energy have meant that getting new permits is now taking longer as the understaffed teams face an ever-growing backlog.

There’s also lots of discussion about if the US shale production has topped out and it’s a possibility. Scott Sheffield, whose company Pioneer Natural Resources was acquired by Exxon, admitted one of the big reasons to sell was they were running out of Tier 1 inventory.

Now I don’t think US production will fall off a cliff, but I think it’s a real stretch that US production growth will come anywhere near 3mm bbl/d (and may be flat for all of Trump’s presidency).

But what about a US recession?

The government layoffs, mass boycotts, and tariff uncertainty are already having an impact on the US economy. Many of the sentiment surveys show consumers and businesses pulling back on spending.

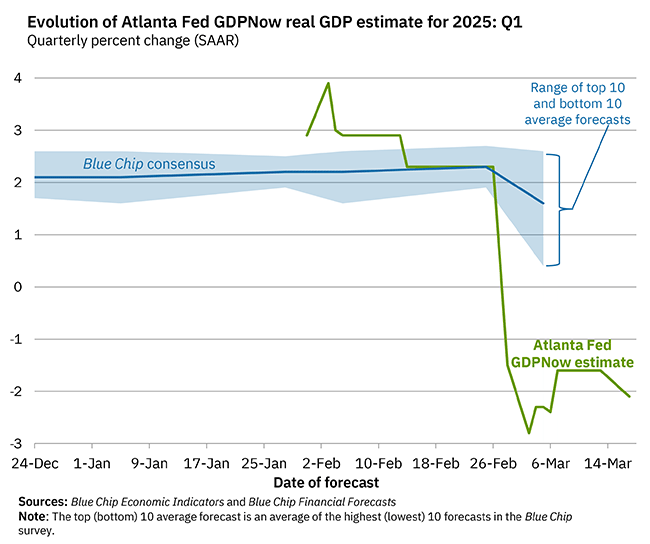

The AtlantaFed’s GDPNow model (which I’ve referenced in the past) has gotten a lot of attention recently.

It looks really bad, although I think it’s a tad overboard (largely due to the flow of physical gold from London to New York). The direction is more important and it looks likely that a big slowdown in US growth is coming (whether it results in a recession or not is to be determined).

So that must be bad for oil prices, right?

In a vacuum sure. The US is the world’s largest consumer of oil at 21mm bbl/d. But it’s not the only consumer of oil. China (16mm bbl/d), Europe (10.5 mm bbl/d), and Japan (5.6mm bbl/d) whose economies have been in recession for the last couple of years are now bringing out the fiscal stimulus and will likely return to economic growth.

If the US goes into a recession but China and Europe start growing again. Is it a wash? I’m not sure.

Trump going after China is an economic risk (and a threat to oil). But Xi and the CCP are well aware of it and this weekend committed to significantly boosting domestic demand (which would have been unheard of even a year or two ago).

The heady days of significant oil demand growth every year are over. But the extremely pessimistic projections (led by the IEA) of a 1mm bbl/d (or more) of excess supply this year won’t happen.

(sidenote: The IEA has been consistently wrong for 10+ years now, why anyone pays attention to their forecasts is a mystery to me).

Flat oil demand (globally) I think would be bullish for oil prices given sentiment and positioning.

But what about a peace deal between Russia and Ukraine?

Another argument to be bearish is the possibility of a ceasefire or peace deal between Russia and Ukraine.

The data shows that Russian oil production and exports have not been impacted by the war at all.

A peace deal or ceasefire may cause Russian natural gas to head back to Europe and put pressure on European natural gas prices. This would cause immense pain and stress on the US shale and LNG industry (but that’s another story). But it wouldn’t impact oil prices.

Ukraine continues to hit Russian oil refineries and other domestic infrastructure, but they’ve rarely attacked Russian oil export facilities on either the Baltic or Black Seas (likely at the demand of the US and European governments).

So if oil drops on news of a Russian ceasefire, take the buying opportunity to get long.

But what about OPEC+ and their spare capacity?

This is probably the biggest risk to oil markets. Just look at a couple of weeks ago when they announced they would be bringing more supply (which surprised the markets) and oil dropped like a stone.

That being said, I think the threat is somewhat overstated.

On paper, OPEC+ spare capacity is between 5mm and 6mm bbl/d. And if all of that oil came onto the market oil prices would crash.

First, there’s been significant cheating by OPEC+ members (led by Iraq and Kazakstan) who have produced well above their quotas. To the point that it was impossible to hide.

So raising OPEC+ production was as much acknowledging reality as anything else.

Second, I think that the spare capacity is also overstated. Saudi Arabia has (on paper) 3mm bbl/d of spare capacity. Today, Saudi Arabia produces 9mm bbl/d while it claims to have 12mm bbl/d of capacity.

The problem is that they’ve never actually produced close to that in history.

During the depths of Covid, the Saudis very briefly (for a couple of weeks) produced over 11mm bbl/d. But they’ve rarely ever exceeded 10.5mm bbl/d.

(sidenote, some news articles mentioned they produced over 12mm bbl/d during that period but that included emptying storage facilities).

So could the Saudis produce 12mm bbl/d sustainably and long-term? I have no idea but I’m skeptical.

But if you cut the Saudi’s spare capacity by half (or more), and adjust for the cheating going on. OPEC+ real spare capacity is not nearly as large (or scary).

So Where Could I Go Wrong?

I think the biggest risk is that I underestimate the destabilizing impact of Trump’s tariffs. There’s a chance that his global tariffs overwhelm the fiscal stimulus being done by the Europeans and Chinese.

And the whole world falls into a recession (which dents oil demand). Quite possible and I’d put this at a 25% - 33% chance.

Another area that I might be wrong about is that I’m underestimating Trump’s deregulatory drive which lowers shale drillers breakevens. This seems far less likely but if you completely gut all the environmental regulations (and worker health and safety) maybe it will happen.

Still seems remote and I’d put only a 10% to 20% chance that US oil production will rise substantially from here. And there’s no chance Trump/Bessent’s goal of 3mm bbl/d of production will happen barring a major technological breakthrough.

Lastly A Word On EVs

Electric vehicles are back in the news this week with Chinese leader BYD announcing a new fast charging (peaking at 1,000 kilowatts or 1 megawatt) in minutes or less. I’m no expert but I’ll just leave a cautionary note.

Fast charging isn’t new, it’s just that there have been two big hurdles. First, rapid charging has historically caused a lot of damage to the batteries and dramatically shortened their lifespans.

If BYD has solved this problem, then hats off to them because it’s a major achievement.

The second and major difficult problem is the grid and electrical infrastructure (or lack thereof). In most of the world, the electricity grid struggles to provide enough power now (especially with demand growth from data centers).

So where will the power come from? Say you have a charging station with 20 of these fast chargers. You’re looking at a peak energy drain of 20 mWh which is an enormous amount of electricity. For comparison’s sake, the average US home uses 900 kWh per month.

And it’s not just the demand but the variability that makes it tough. During slow periods (such as at night or middle of the day) the charging station may barely be used (or empty). While during rush out they could be full.

How will they be able to overcome these hurdles? No idea but it will require much smarter people than me. The most likely solution would be massive grid-scale batteries that can store huge amounts of energy overnight and then discharge during the day. But we’re talking massive batteries here (and very, very expensive).

So near term (next 5 years), overall oil demand isn’t likely to be impacted by EVs. After that who knows, but it’s beyond investor’s time horizon so we’ll get there when we have to.

Thanks for taking the time to read all of this and good luck out there (and enjoy the Spring).

Trades:

Sale:

Pembina Pipelines (PPL)

Buys (to 10% weight):

Whitecap Resources (WCP)

Portfolio Holdings:

Canadian Portfolio:

Global Portfolio:

Performance

Canadian Portfolio:

Global Portfolio:

Disclosure: I am long and have a beneficial interest in all of the above-mentioned securities. I may change my holdings at any time post-publication.

Disclaimer: This newsletter and/or any other articles that I publish should not be construed as investment advice. None of the strategies or securities mentioned should be considered as an investment recommendation to buy or sell. I am not an investment advisor and I highly recommend that anyone considering this investment strategy or any of the securities first consult with a registered investment advisor to assess both the suitability and risk of any strategies or securities that are mentioned.

Any thoughts on the recent pullback in ATD which has been a core holding of mine for years. I have ascribed mainly to the 7-11 buyout offer but wondering if I’m missing anything. Otherwise this might be good opportunity to add

Beyond some securities that haven’t vested I also recently pulled out of U.S. entirely. Seems the rotation to most any non U.S. market has worked well short term, especially China. Erik at YVR suggested BIDU as a potential laggard that could offer a decent entry here. He’s been great on the China call so far.